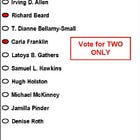

Why Would Greensboro City Council At-Large Candidate Richard Beard Lie?

A false statement about a tax filing hides a pattern of soaring salaries, explosive travel expenses and a stark lack of diversity.

I originally asked for City Council Candidate Richard Beard’s taxpayer funded Greensboro Sports Foundation 990 Tax Return on August 27, 2025.

Richard Beard first replied on the same day “Thank you for reaching out. You can find that publicly, just like any 990.”

The return wasn’t available online. I replied “Only goes through fy 22-23. Has the 23-24 been filed?”

https://pdf.guidestar.org/PDF_Images/2023/822/986/2023-822986873-202431299349302993-9.pdf

Beard replied “GSF is under an extension for 2024 taxes.” Which wasn’t true, as we found out on September 30, when Richard provided the 23-24 990 tax return.

The 23-24 Greensboro Sports Foundation 990 Tax Return was filed and accepted by the IRS on May 14, 2025.

City Council Candidate Richard Beard lied about when the taxpayer funded Greensboro Sports Foundation’s FY 23-24 990 Tax Return was filed, which shows $776,714 in total revenue with 27 directors, of which only one, Marikay Abuzuaiter, is female.

Could it be that in light of what’s happening to Zack Matheny, Richard didn’t want voters to know the taxpayer funded foundation he runs spent $13,954 on “Sponsorship/Tickets” after spending $3,250 in 22-23, $1,133 in 21-22 and nothing noted for 20-21 when he wasn’t President yet?

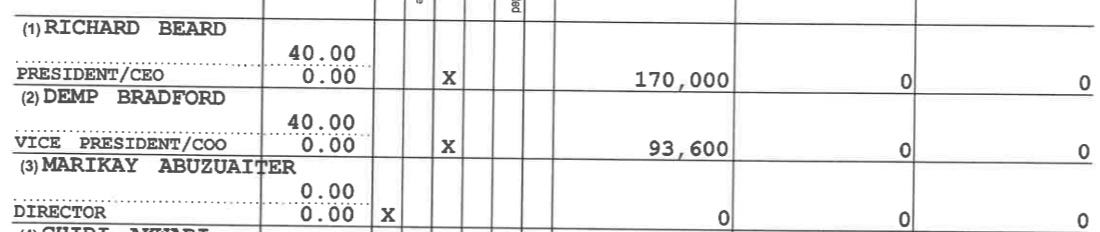

The tax return also says Both Beard and Demp Bradford both work 40 hours a week for the foundation, which is highly unlikely;

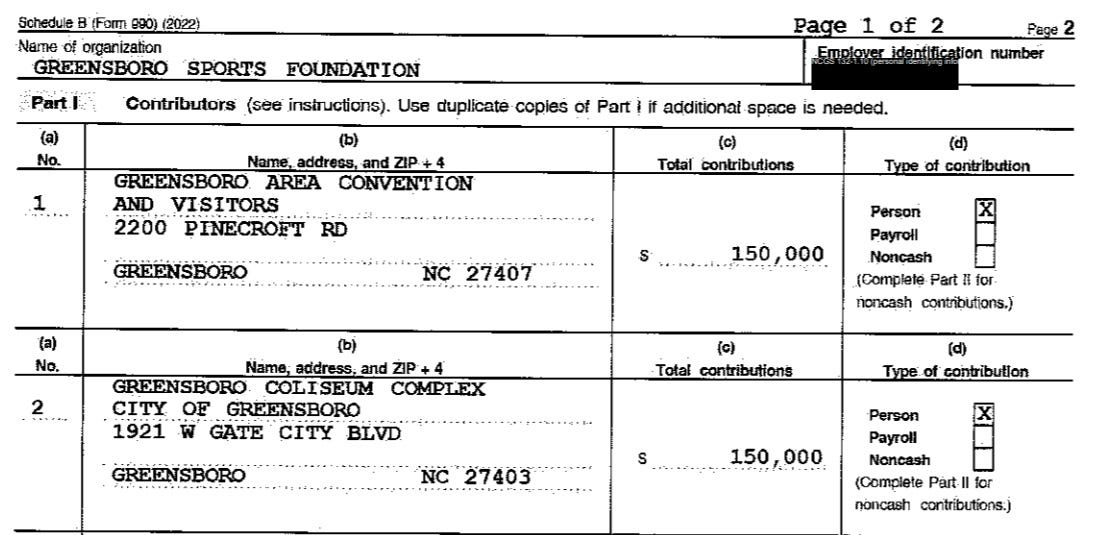

The prior year;

Richard Beard’s compensation; $170,000, $20,000 or 13.3% more than the year before.

Beard’s compensation is ≈21.89% of the Foundation’s 23-24 revenue.

Did Richard not want voters to know how much more he made year over year, or did he not want voters to know he made 121.18% more than the prior President made in 20-21, whose compensation was $76,875?

Kim Strable, the President of the Greensboro Sports Commission, which became the Greensboro Sports Foundation in FY 2019, made $48,000

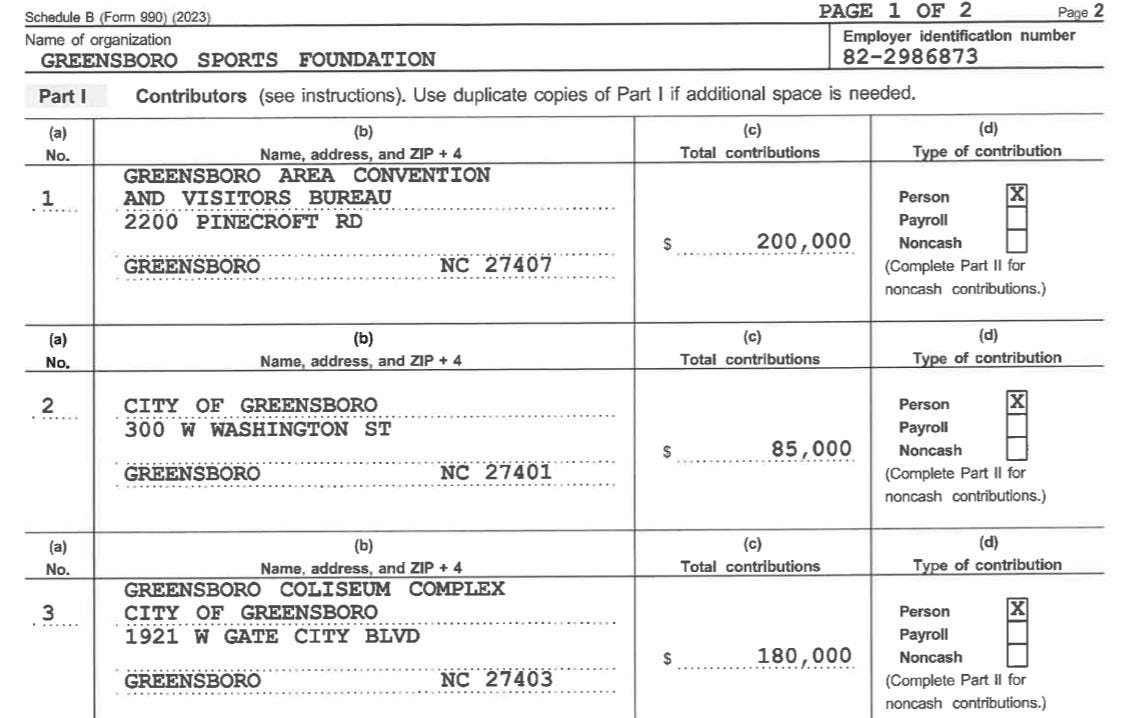

Did he not want anyone to know his salary is 36.56% of what Greensboro taxpayers kicked in?

Or did Beard not want voters to know taxpayers gave the Sports Foundation $165,000 more year over year?

Maybe Richard didn’t want the public to know how much the Sports Foundation spent on Travel and Hospitality after big spending the year before, which Beard and the Foundation has so far declined to provide details of?

2019; Travel $2,917

2021; Travel $21,333

2022; Travel $11,750

2023; Travel $104,302

2024; Travel $9,933

2019; HOSPITALITY $0

2022; HOSPITALITY $0

2023; HOSPITALITY $127,357

2024; HOSPITALITY $0

The evidence compels a difficult question; what exactly was Richard Beard trying to hide? His initial lie about the tax filing status was not a minor oversight; it was a deliberate barrier erected to prevent public scrutiny. Behind that barrier lay a troubling financial portrait; a soaring salary that consumes an outsized portion of taxpayer funding, explosive and unexplained spending on travel and hospitality, and a stark lack of diversity in leadership.

Whether the motive was to conceal the dramatic increase in his own compensation, the foundation’s questionable expenditures, or simply the timing of this revelation amid another councilmember’s scandal, the conclusion is the same. A candidate for public office intentionally misled the public about the finances of an organization he runs, and the truth he sought to obscure reveals a pattern of fiscal practices that voters have every right to question before they cast their ballots.

Related;

A Note on Sourcing and Analysis: This article is an analytical piece based exclusively on fact. The primary sources are the official IRS Form 990 tax returns for the Greensboro Sports Foundation, which are legal documents required for public inspection. The timeline of events is constructed from direct correspondence with the subject, Richard Beard. The assertion that a statement was untrue is not an opinion but a factual conclusion drawn from the discrepancy between the provided statement (”GSF is under an extension”) and the IRS filing date of May 14, 2025. All financial calculations and percentages are derived directly from the cited 990 forms. Questions raised about spending, compensation, and representation are for public consideration and are based on the data contained in these public records.