Crumbling Commercial Values Threaten Guilford and Greensboro Homeowners with Steep Tax Hike

Empty Offices, Higher Home Bills; The 2026 Tax Reappraisal's Stark Choice

Homeowners face a potential “double-hit”; higher assessments on their own homes and increased tax rates to make up for lost commercial revenue.

Guilford County commercial/office property values are plummeting.

The 2026 countywide tax reappraisal will formalize these crashes.

This collapse in the commercial tax base threatens to blow a hole in city and county budgets, which rely on property tax revenue.

Property owners can appeal their new assessments.

As Guilford County property owners begin receiving new valuation notices this month, a troubling fiscal reality is coming into focus; while residential values have surged dramatically, a significant portion of the commercial tax base, particularly office properties and commercial buildings in Greensboro, face steep devaluations. This growing divergence threatens to force a major tax rate increase onto homeowners to fill the resulting revenue gap.

The Resetting of the Tax Base; A Tale of Two Markets

The 2026 property reappraisal, triggered early by state law, aims to bring all county property values to current market value. Guilford County Tax Director Ben Chavis has projected the county’s overall real estate tax base will increase by 40 to 45 percent on average, though the impact will vary widely.

Behind this average lies a stark split;

Residential Market; Fueled by pandemic-era demand, tight supply and population growth, residential values have skyrocketed. Notices for residential properties will begin mailing in mid-February.

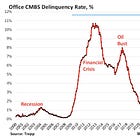

Commercial Market; Many commercial properties, especially older office buildings, are heading in the opposite direction.

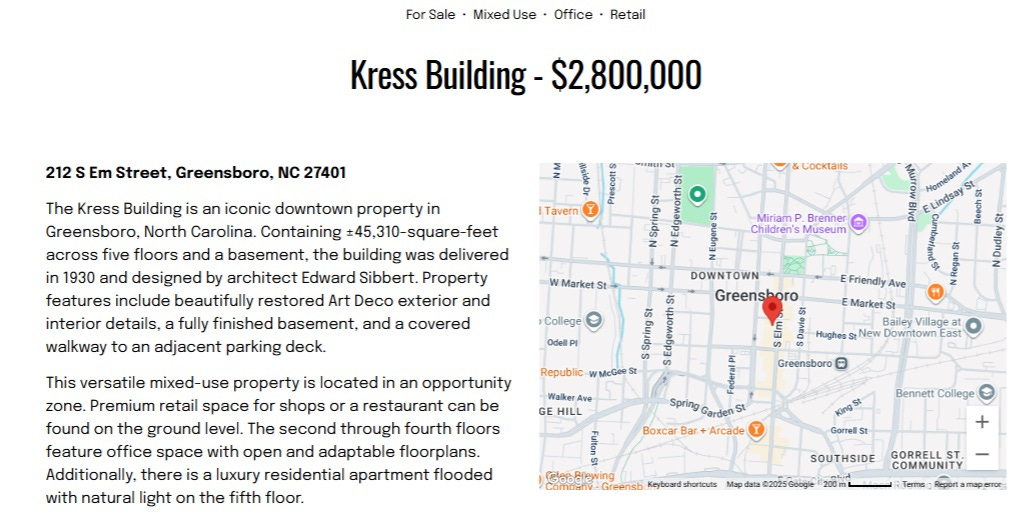

Example One;

Simpson Commercial had the Kress Building at 212 S Elm St, which last I checked was empty, is listed for $2,800,000;

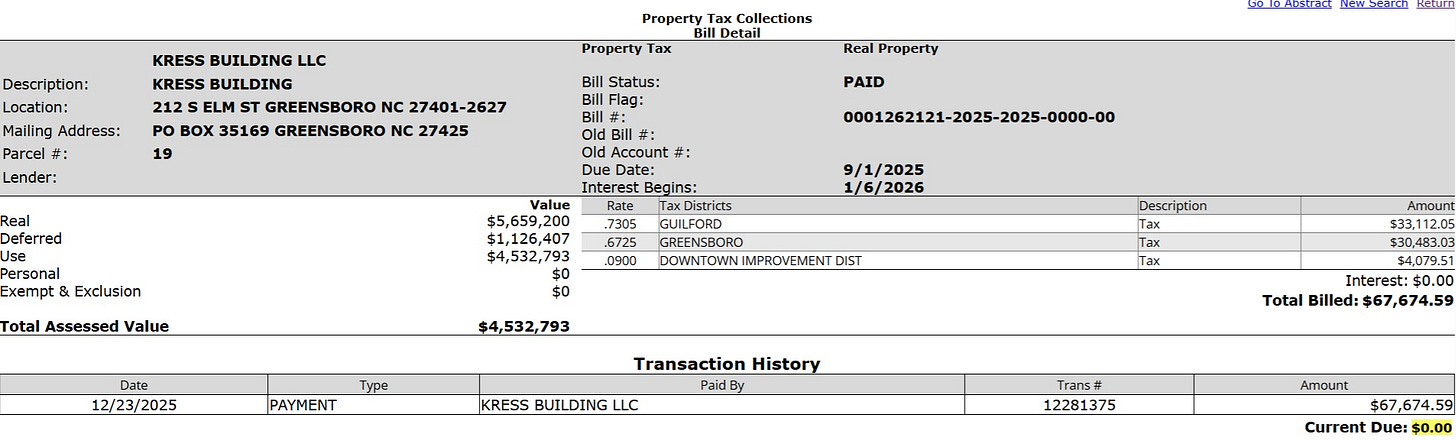

The Kress was assessed at $5,659,200 with $1,126,407 “Deferred” as of 2025;

$5,659,200 - $2,800,000 = $2,895,200 less in 2025 than 2021

50.5% less than 2025

Example Two;

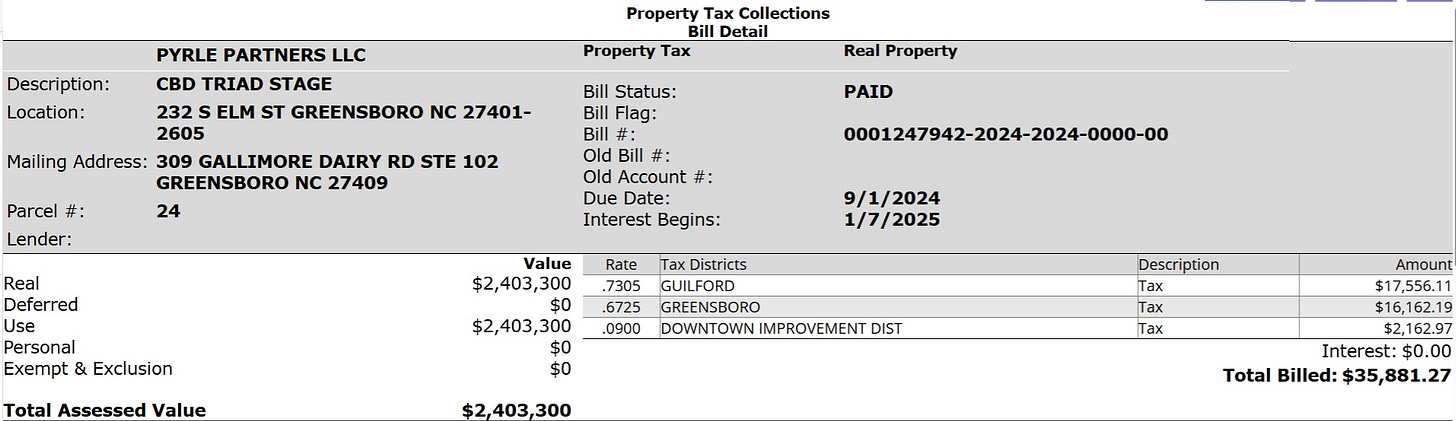

The building at 232 S. Elm, now called the Pyrle Theatre, housed Triad Stage for nearly 20 years. Arthur Samet, Will Stewart, Durant Bell, Jeff Yetter and Daniel McCoy purchased the building in January 2024 for $1.35 million at auction, which was assessed at $2,403,300 in 2024;

The purchase price was $1,053,300 lower than the assessed value, a difference of 43.8%.

For the first time, Guilford County is formally using the income approach for commercial valuations, which calculates value based on a property’s revenue potential. With remote work reducing demand, commercial vacancies rising and income falling, this method will result in significant value reductions. Commercial property notices are scheduled for March.

Using actual revenue potential rather than just comparable sales will likely reveal how badly office buildings are struggling with remote work impacts. This is methodologically sound but will expose painful realities.

Example Three; Office Vacancy Rates;

As both the Pyrle and Kress are in downtown Greensboro, with the second highest asking prices for rent and the second lowest stated vacancy rates as of 2024, the rest of the county minus West Greensboro may take a big hit within revaluations.

The Tax Rate Squeeze; Why Homeowners Will Likely Pay More

The tax bill a property owner receives has two components; the assessed value (determined by the reappraisal) and the tax rate (set by elected officials in June 2026). Officials set the rate based on the total revenue needed to fund the county and city budgets.

Residential property accounts for roughly 65% of Guilford County’s tax base. If the total value of commercial properties shrinks dramatically, by 20%, 30% or more as some experts predict, it creates a massive hole in projected tax revenue.

County and city budgets, already strained by inflation and billions in debt, must be funded. To generate the same revenue from a smaller commercial base and a larger residential base, the government has two choices; drastically cut services or raise tax rates. Historically, politically difficult cuts are avoided.

Homeowners face both higher assessments AND potentially higher rates if officials don’t cut spending proportionally. That’s how reappraisals can become particularly punishing.

The result is a likely “double-hit” for residential taxpayers;

Property assessments have risen.

The tax rate applied to higher values may increase to compensate for the commercial sector’s collapse.

This could mean effective tax bill increases far beyond the value hike alone, impacting renters as landlords pass on costs.

A Call for Equity and Accountability

As Guilford County commissioners and city council members prepare to set tax rates this June, they face a fundamental question of fairness. They should pursue true revenue neutrality to protect homeowners from bearing an unequal burden due to commercial devaluation and a stalled residential housing market with falling prices. As Commissioner Skip Alston stated, transparency and taxpayer input in this process are essential.

The 2026 reappraisal is more than a routine adjustment, it’s a stress test for fiscal equity. Without careful and just decisions from elected leaders, the bill for a shifting economy will land squarely in the mailboxes of Guilford County’s homeowners.

Will our elected leaders actually adjust rates downward to be revenue-neutral, or will they pocket the increased revenue from residential gains while using commercial losses as cover?

Property owners can appeal their new assessed values based on two valid reasons;

The market value substantially exceeds the actual market value of the property.

The market value is inconsistent with the market value of similar properties within your neighborhood.

Invalid reasons to appeal;

The market value increased too much compared to the 2022 market value.

The market value is more than the construction cost.

The market value is more than the insurance value.

The market value is just too high.

The owner does not have the financial ability to pay the taxes.

Related;

https://www.rhinotimes.com/featured-article/property-values-up-up-and-away-in-guilford-county/

Disclaimer

1. Informational and Analytical Purpose; This article is published by Public Integrity Watch for informational, educational, and analytical purposes. It constitutes commentary and analysis on matters of public policy and finance. The content is intended to foster discussion and understanding of local fiscal issues and is not presented as financial, legal, real estate, or tax advice.

2. Data Accuracy and Forward-Looking Statements; The analysis is based on publicly available data, including property records, tax assessments, and market listings at the time of writing. While efforts are made to ensure accuracy, data can change, and readers are encouraged to verify information directly with official sources such as the Guilford County Tax Department.

The article contains forward-looking statements and projections regarding potential tax impacts, property value trends, and government actions. These statements are inherently speculative and based on current conditions, analysis of available data, and historical patterns. Actual outcomes may differ materially due to numerous factors, including decisions by elected officials, economic shifts, and changes in state law.

3. Not Professional Advice; Nothing in this article should be construed as personalized advice. Property tax matters are complex and vary by individual circumstance. Readers facing decisions related to property valuation, tax appeals, or financial planning should seek counsel from qualified professionals, such as a certified tax attorney, a licensed real estate appraiser, or a certified public accountant.

4. Opinion and Advocacy; This article reflects the analysis and viewpoint of the author, George Hartzman. It interprets public data within a specific analytical framework to argue a point of view regarding local tax equity and policy. It is an exercise in opinion journalism and civic commentary.