Public Hearing; 2026 Property Tax Reappraisal; Follow up to 2022's Massive Tax Increase for Greensboro and Guilford County

Thu, Oct 2 2025, 5:30pm, Commissioners’ Meeting Room, 2nd floor, Old County Courthouse; 301 W. Market Street Greensboro NC 27401

Guilford County residents are bracing for what could be another historic property tax increase as the Board of Commissioners prepares for a pivotal public hearing on 2026 reappraisal rules. Residential property values across the county are projected to rise while many commercial office real estate values decline, setting the stage for steep homeowner tax bill hikes.

In 2022, Guilford County raised taxes to an equivalent of a tax increase of 13.41 cents. The result led to the county to increase tax revenues be about $92 million.

The Rhino Times’ Scott Yost reported at the time; “the bill for a median home in Guilford County will go up by $418. A good rule of thumb for this year is to expect your property tax bill to go up by a third.”, not counting the increased tax bite by the City of Greensboro the same year.

Greensboro’s budget resulted in a 8.69 cent tax increase.

A Greensboro staff report noted an estimated average property tax increase of about 30 percent in 2022. Councilmembers Abuzuaiter, Hightower, Hoffmann, Holston, Thurm and Wells voted in favor of the tax hike.

Tax Spike: The Central Issue

With the 2026 reappraisal, the county tax office estimates average property value jumps near 48% for homes and businesses. Without adoption of a revenue neutral rate, thousands could see double digit increases in their annual tax bills, echoing 2022’s surge, widely regarded as the largest tax increase in Guilford County history.

Local advocates and elected officials are already warning that this looming spike will hit families, renters and some small businesses across both Greensboro and High Point and the rest of Guilford County, fueling calls for reform and tax relief.

Familiar Faces on the Board;

Commissioners who voted for the 2022 tax windfall remain in control and will lead the 2026 reappraisal process;

Melvin “Skip” Alston (Chairman, At-Large) presided and voted in favor of the 2022 tax increase. Kay Cashion (At-Large) voted in favor of the tax increase. Carlvena Foster (District 1) voted in favor of the tax increase.

Their ongoing presence means the policy direction is likely to be familiar to residents who absorbed the last increases. Public trust in the Board’s willingness to deliver real relief may hinge on whether these same leaders now embrace a revenue-neutral approach, or again retain a rate that maximizes county revenue.

City of Greensboro Tax Hikes;

In Greensboro in 2017, City Council kept the same tax rate, which resulted in a stealth tax increase, only not as big as 2022. Nancy Vaughan, Yvonne J. Johnson, Marikay Abuzuaiter, Mike Barber, Nancy Hoffmann and Justin Outling voted for it.

In June, 2019, Greensboro’s City Council increased taxes again in a move reinforcing its position as the city with the highest tax rate in the state for a comparable municipality. Nancy Vaughan, Yvonne J. Johnson, Marikay Abuzuaiter, Sharon M. Hightower, Nancy Hoffmann, Michelle Kennedy, Justin Outling, Tammi Thurm and Goldie F. Wells voted for the tax increase.

The council has paired property tax increases with regressive fee policies like the universal $2.50 monthly recycling fee among water and sewer fee increases of 2019. This flat fee was a significant departure from the progressive nature of property taxes. It ignored a household’s ability to pay, charging the owner of a modest $40,000 home the same amount as the owner of a $4 million property. Nancy Vaughan, Marikay Abuzuaiter, Hugh Holston, Nancy Hoffmann, Zack Matheny, Tammi Thurm, Jamilla Pinder, Sharon Hightower and Goldie Wells have voted multiples of times for regressive fee increases at the expense of the poorest among us.

Commercial Real Estate vs. Residential Real Estate;

After the budget votes for 2022 tax increases, the International Civil Rights Center & Museum in Greensboro received significant public funding for a major expansion, with both the City of Greensboro and Guilford County each contributing $2 million towards the museum’s $10.25 million purchase of an adjacent building and land. Skip Alston recused himself for the vote due to his affiliation with the museum, yet he now has an advertisement for his real estate business on the property.

In “The Kress Lomax Cover-Up; How Greensboro’s Press Ignores a Web of Power, Money and Backroom Deals”, I noted John Lomax’s asking price for his elm street building fell from $5,659,200 to $2,800,000, or 50.5% less than 2021;

Chances are the value of the Civil Rights museum $10.25 million purchase has lost a similar amount of value, as well as many other commercial office buildings around the county, meaning residential property owners are going to have to make up the difference in revenue.

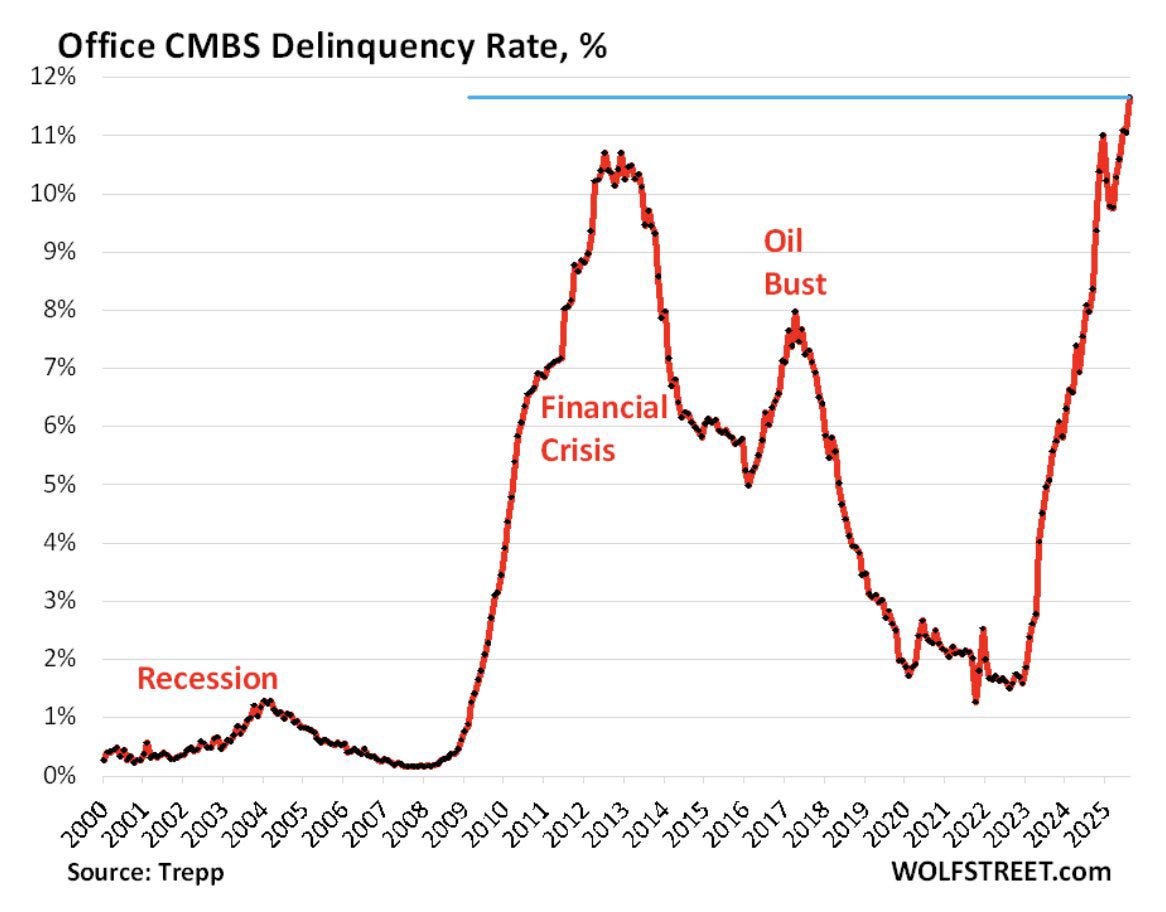

The challenges facing commercial real estate, particularly office space, are systemic and severe. The value declines noted are not isolated incidents but part of a national trend. Companies have realized they need less office space. Leases are not being renewed or companies are downsizing their footprint when they do renew. Empty offices generate no income for their owners, which directly translates to a lower appraised value for property tax purposes. Older, less desirable (”Class B” and “Class C”) buildings are being left behind. Many are becoming functionally obsolete and are difficult to lease at any price.

Local residential property values saw a massive run up during the pandemic and values remain well above pre 2022 revaluation levels. This has created a situation where residential property is going to be taxed at or near peak values, while a big chunk of commercial office property is undergoing a massive, rapid devaluation. If dozens or more commercial properties across Guilford County see their taxable values fall by 20%, 30%, or even 50%, it creates a massive hole in the county’s and city’s projected tax revenue.

The Inevitable Shift to Homeowners;

To cover the budgets and to pay for ongoing services, local governments have only two choices; Drastically cut services (politically very difficult) or raise the property tax rates. Because the total value of the commercial tax base may shrink, a higher tax rate will be necessary to generate the same amount of revenue. Chances are, homeowners will see their tax bills increase to “make up the difference.”

The Transparency Problem in Guilford County’s Property Revaluation;

The methodology behind Guilford County’s property revaluation is largely secret. While the county has published some general information online, the core formulas used to calculate property values are copyrighted by a private company, Marshall & Swift (now part of CoreLogic).

Because of this copyright, the detailed valuation tables are not available to the public. Taxpayers can only view them under strict supervision in a county office, without the ability to take notes or photos. This means that while the law allows for inspection, in practice, the most critical part of the process, the data that will determine 2026 tax bills cannot be independently reviewed, copied or studied by the property owners who will be footing the bills, creating a fundamental lack of practical transparency.

No Independent Analysis;

A homeowner, a local journalist or a civic watchdog group cannot obtain a copy of the manual to study it systematically. They cannot run sample properties through the formulas, compare neighborhoods or audit the methodology for consistency and fairness. This prevents the very scrutiny public processes are meant to endure.

If a homeowner appeals an assessment, they are arguing against a system they cannot fully see or understand. The county holds all the cards; The data, the formulas and the experts who know the system intimately. This turns the appeals process from a debate over facts into a battle where one side has a hidden rulebook. When the 2026 revaluation hits and residential values are assessed at levels that feel inflated relative to a softening market, the county’s response will be, “This is the result of our professional, standardized system.” But when the core of that system is secret, the public has no way to verify this claim. It breeds suspicion and cynicism, especially when coupled with the clear commercial downturn.

Commercial Values are Secretly Adjusted Downward; The County Assessor, using the same proprietary system, will be forced to acknowledge the market collapse in commercial values. They will likely apply Marshall & Swift formulas to lower the assessed values of office buildings, including the Civil Rights Museum’s new property and the Lomax building. These reductions will be justified and “by the book.”

Residential Values Will Rise; Due to the assessment lag and the complexity of valuing thousands of unique homes, the revaluation may not fully capture a market cool-down. The copyrighted system might spit out values that are still high, based on outdated data or formulas that don’t adequately reflect rising interest rates and local market conditions. The system is designed for mass appraisal, not nuance.

The Revenue Shortfall is Revealed; The county calculates the total taxable value and discovers a massive hole created by devaluations in the commercial sector.

The Tax Rate is Set to Compensate; To cover the budget, the county and cities announce new, higher property tax rates. They will claim it is a “revenue-neutral” rate or blame it on rising costs, downplaying the impact of the commercial collapse.

Homeowners Bear the Brunt with No Recourse; The Bill Arrives; Homeowners open their 2026 tax bills to see a significant increase due to the combination of a potentially inflated assessment and higher tax rates.

The Appeal is Futile; When they try to appeal, they are told their assessment is correct according to the official, copyrighted manual, a manual they cannot study, copy or independently verify.

The copyright secrecy of the valuation process is the mechanism that will facilitate the transfer of the tax burden. It prevents the public from seeing the direct correlation between the commercial devaluation and their residential tax increase. It obscures the fact that the “standardized” system is applied in a way that systematically shifts liability from a crumbling commercial sector onto homeowners who are already informationally disarmed.

This creates a scenario of taxation without true representation. Homeowners are being asked to fund a government that operates with a secret rulebook, to make up for a revenue shortfall caused by economic shifts and potentially questionable investments, all while being denied the transparent data needed to hold the system accountable.

Related;

Part Of Guilford County Tax Revaluation Process Is A Black Box, by Scott D. Yost | Sep 15, 2025

https://www.rhinotimes.com/news/part-of-guilford-county-tax-revaluation-process-is-a-black-box/

New Guilford County budget will bring property tax increase for many residents

Greensboro OKs $688 million budget and tax increase for most property owners

City Council Passes 2022-20223 Budget With A Nearly 9-Cent Tax Increase, by John Hammer | Jun 22, 2022

Report Shows Greensboro Tax Increase May Be Highest In Nation, by John Hammer | Jul 12, 2022

Here’s Why Your Property Tax Bill Is So High, by John Hammer | Jul 19, 2022

https://www.rhinotimes.com/news/heres-why-your-property-tax-bill-is-so-high/

Guilford County Passes Enormous Budget With Something For Everyone, by Scott D. Yost | Jun 17, 2022

https://www.rhinotimes.com/news/guilford-county-passes-enormous-budget-with-something-for-everyone/

Disclaimer: The analysis and opinions presented in this article are based on publicly available information, market data, and the author’s interpretation of events. The assertions regarding property value trends are extrapolations from specific, cited examples and broader market conditions, and may not reflect the precise valuation of any single property. The conclusions about future tax implications are projections, not certainties, and are subject to change based on government policy, economic factors, and future reassessments. The purpose of this article is to foster public discourse and scrutiny on matters of municipal finance and governance.