Internal DGI Audits Omitted Critical Election-Year Quarters

DGI's December 17, 2020 board meeting notes say "Mr. Matheny expressed interest in running for council".

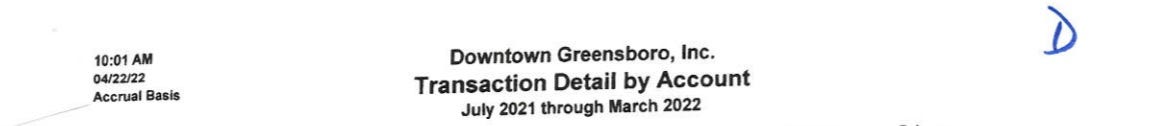

The Internal Audit Division's compliance review of Downtown Greensboro, Inc. (DGI), dated May 17, 2022, failed to include the final quarter of the 2021–2022 fiscal year, April, May, and June 2022, yet states "We examined selected financial transactions and entity files for compliance with the executed agreements. Based on our review, it appears that the funds have been expended in accordance with the agreements, with no exceptions noted."

The ledger provided to the City only went through March, 2022.

The internal Audit Division completed a review for FY 21-22 which ends on June 30, 2022, on May 17th, 2022, with no knowledge of what happened in April May or June, and apparently still doesn’t.

2014-15’s review was completed on March 18, 2015.

2016’s on March 24th.

2017’s on April 26th.

2018’s on April 9th.

2019, could not be located.

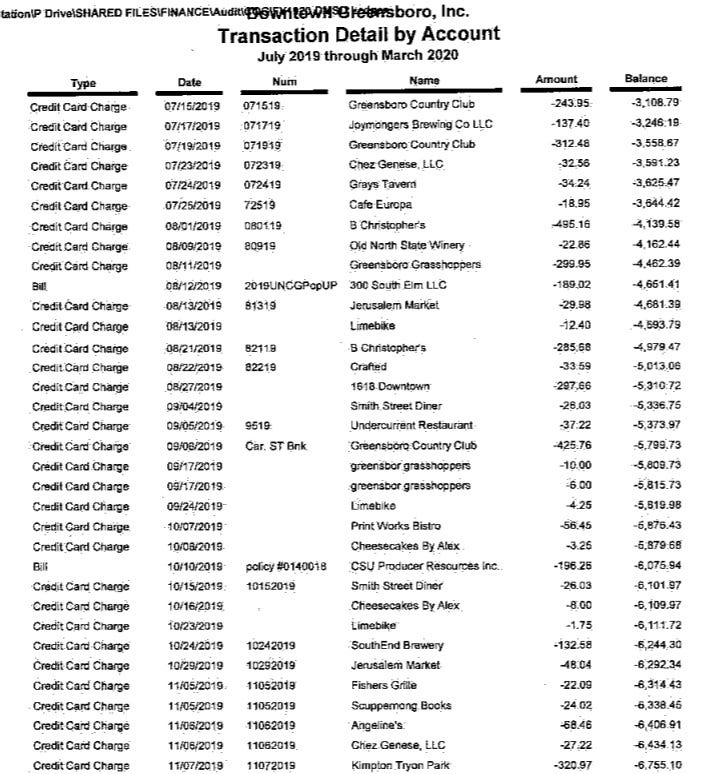

2020 on May 29th on a ledger through March.

2021 wasn’t found on a ledger through May.

2022 ledger through March.

2023 ledger through May 19.

2024 Review dated July 15th, the only year found for a full fiscal year.

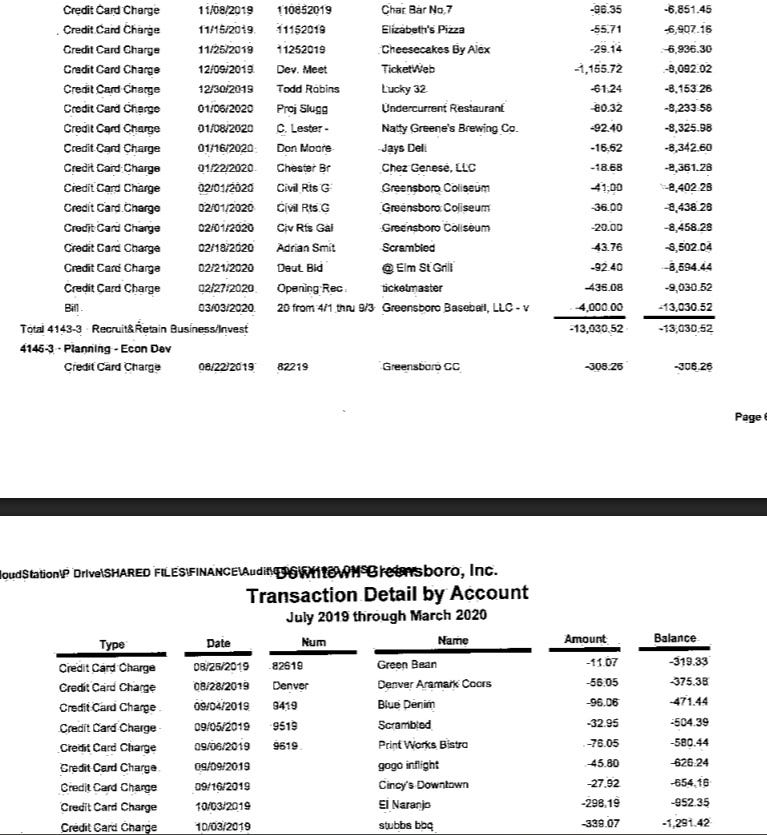

2025 Review dated June 20th, before the end of the fiscal year.

The decisions to issue a compliance reviews before the fiscal years concluded is a clear deviation from established public auditing norms and undermines fundamental principles of accountability and transparency. Under Generally Accepted Government Auditing Standards (GAGAS), audits and reviews must be conducted in a manner that ensures complete, unbiased, and timely oversight of financial and operational activities. By preemptively closing the review period, key transactions, expenditures, or potential irregularities occurring in the final months of the fiscal year, often a critical time for budgetary adjustments and spending, are effectively shielded from scrutiny.

A review that excludes a portion of the fiscal year cannot provide a full assessment of compliance, financial integrity, or performance efficiency. Stakeholders, including taxpayers and oversight bodies, are left with an incomplete picture.

If the timing was/is designed to avoid examining politically sensitive periods (e.g., pre-election spending, year-end discretionary allocations, especially to city staff and elected officials), it risks eroding public trust. Audits must be insulated from partisan influence to maintain credibility.

GAGAS emphasizes that audits should be independent and free from interference, including in their scheduling. Artificially truncating the review window could be interpreted as election interference, regardless of whether it technically complies with legal minimums.

Allowing such exceptions sets a dangerous precedent, encouraging future administrations or agencies to manipulate audit timing to avoid accountability.

Matheny has been CEO of DGI since 2015.

A valid annual audit must review the entire fiscal year (July 1, 2021 – June 30, 2022). By issuing the audit in mid-May, the City’s Internal Audit Division excluded the last three months of financial activity, including any actions or expenditures leading up to and during the May 17, 2022 primary election and the general election on July 26.

On 02/18/2022, some from the ACC enjoyed a $2,944.59 tab at B Christopher's with Zack.

In the primary, Zack defeated opponents Chip Roth and Bill Marshburn. Shortly after, Roth announced he was withdrawing from the race due to a prostate cancer diagnosis and publicly endorsed Matheny. As a result, Matheny ran virtually unopposed in the general election and took office on August 11, 2022.

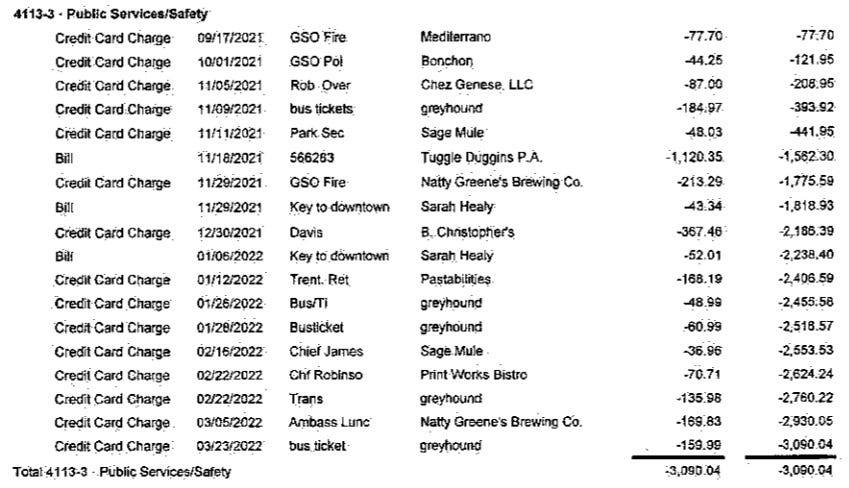

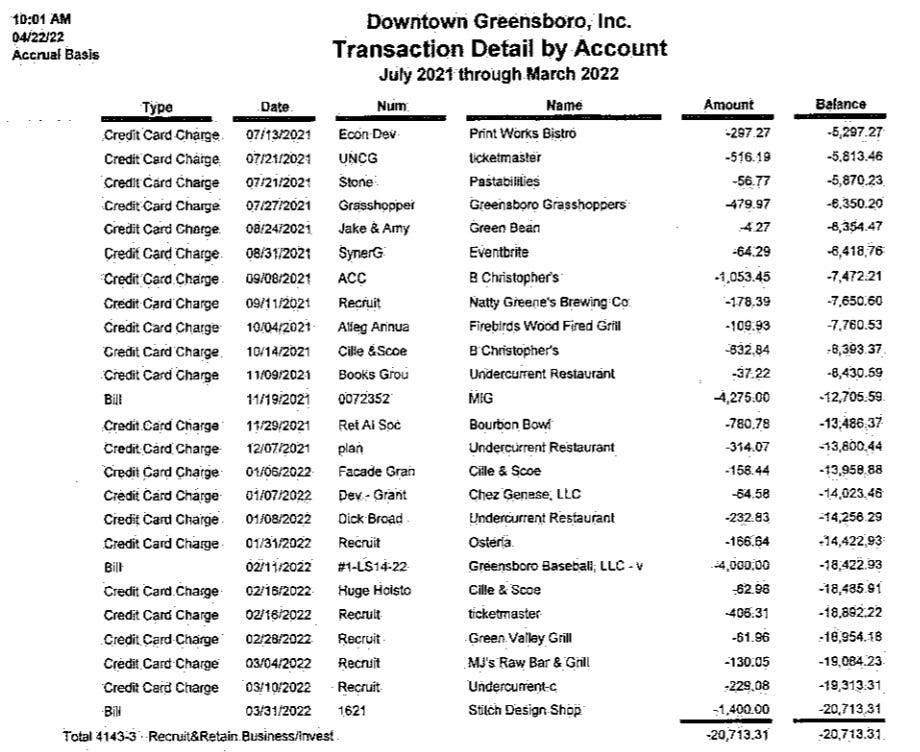

Some 2021-22 DGI taxpayer funded spending;

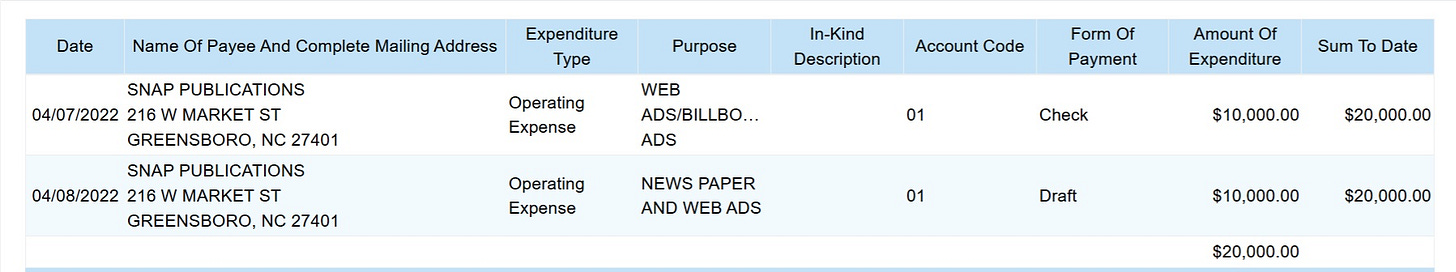

While Zack Matheny was running for office during the last fiscal quarter, there remains a period of unknown spending by DGI that Greensboro’s audit department has no record of or knowledge about, leaving a gap in accountability for taxpayer-funded expenditures. What is known from DGI’s 2021–2022 Communications and Marketing records is that at least $58,601 had been spent through March 27, 2022, with vendors including WGHP, Triad Business Journal, Womack Publishing, Snap publications (Roy Carroll), the News & Record, Dick Broadcasting (Matheny political contributor), O’Henry, and WFMY, suggesting that additional, unaccounted-for spending during the same timeframe could be significant, and could have effected the May 17 primary and Roth's decision to step aside after before the July 26 general election.

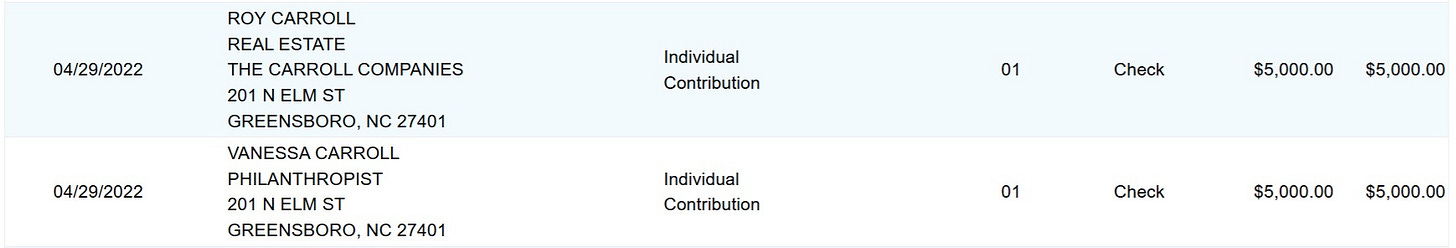

Of what is known, Matheny’s campaign also made substantial payment’s to Roy Carroll’s Snap Publications before Roy’s $10,000 contributions;

There is a $73.92 taxpayer funded Roy Carroll charge at Undercurrent Restaurant on July, 2, 2021.

On March 8, 2024, Chip Roth and Eric Chilton attended a “DMSD” taxpayer funded meal at Elm Street Grill, with the $344.77 expense charged to the American Express card held by Zack. Chip’s wife and former City of Greensboro Manager Denise Roth is currently running for City Council, and Eric Chilton is now the Strategic and Crisis Communication Manager for the City of Greensboro.

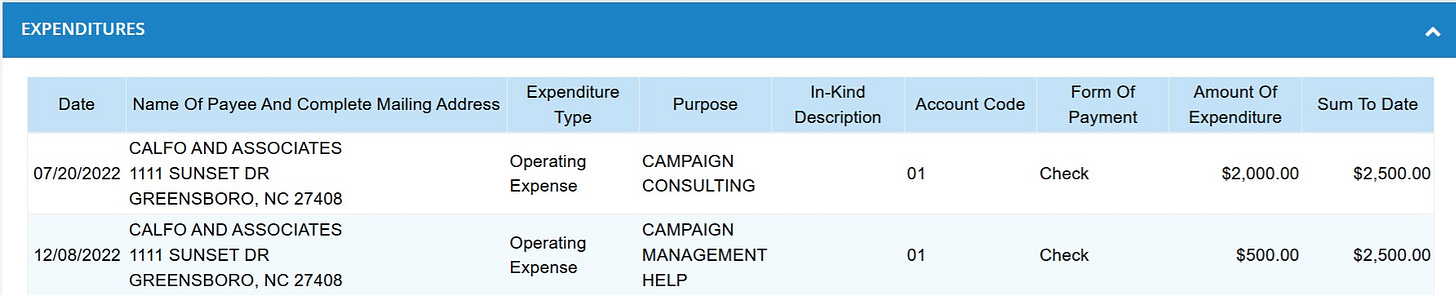

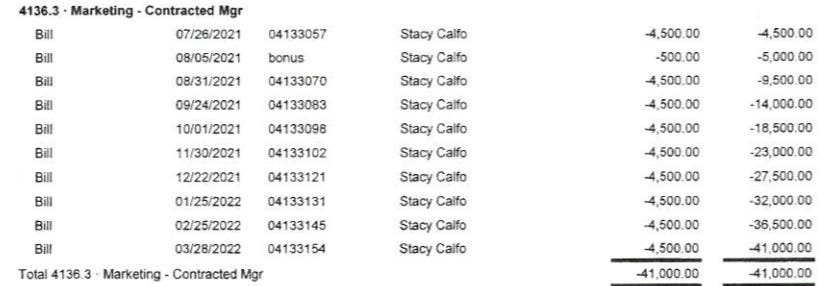

Matheny also intertwined marketing and his 2022 campaign;

From DGI’s ledger;

Some more very questionable 21-22 spending preceding the election;

On June 20, 2025, DGI’s City of Greensboro Compliance Review at least omitted transactions right before another election. The City has yet to release the 24-25 Ledger;

The pattern is unmistakable; Greensboro's audit process has repeatedly failed to scrutinize DGI's taxpayer-funded activities during critical election periods, creating convenient blind spots obscuring potential misuse of public resources. With the City withholding the 2024-25 ledger and the June 2025 compliance review again omitting pre-election, end of fiscal year transactions, this isn't administrative oversight, it's systematic enablement of financial opacity protecting political interests at taxpayers' expense. Until Greensboro demands complete fiscal transparency and closes audit loopholes and actually holds local non-profits accountable to contracts, residents have every reason to question whether their tax dollars are funding public benefits, political campaigns and/or personal enrichment.

Some more without any descriptions or purpose;

Disclaimer: This report draws on publicly available records, official audits, vendor payment data, and election filings to highlight apparent gaps in oversight and potential conflicts involving publicly funded expenditures. Some financial records—particularly for the final quarter of the 2021–2022 fiscal year and other unreleased ledgers—were not made available by the City of Greensboro or Downtown Greensboro, Inc. at the time of publication. As a result, certain spending remains undocumented in official reviews. References to individuals, businesses, or political campaigns are made strictly in the context of matters of public concern. No conclusions are offered beyond what the documented evidence supports, and any implications regarding intent, legality, or ethics are left for readers to assess based on the disclosed facts.