How Hedge Fund Leverage, Corporate Accounting Tricks, a Strained Power Grid and Everyday Cost-of-Living Pressures Are Driving the System Toward Crisis

The U.S. economy is building up to another major financial meltdown.

This time, the threats go beyond Wall Street’s books, they’re hitting the real-world limits of the nation’s power grid, industrial base and the household budgets of ordinary Americans. The dangers stem from massive leverage in hedge funds and shadow banks, shady corporate accounting, murky private credit deals, sky-high costs for housing, healthcare, education, food, and an electric grid that’s buckling under the weight of the AI-fueled digital boom. Regulators are aware of the risks, and the Federal Reserve is practically waving red flags. But spotting the problem isn’t the same as solving it, and almost nothing has been done to address the core issues.

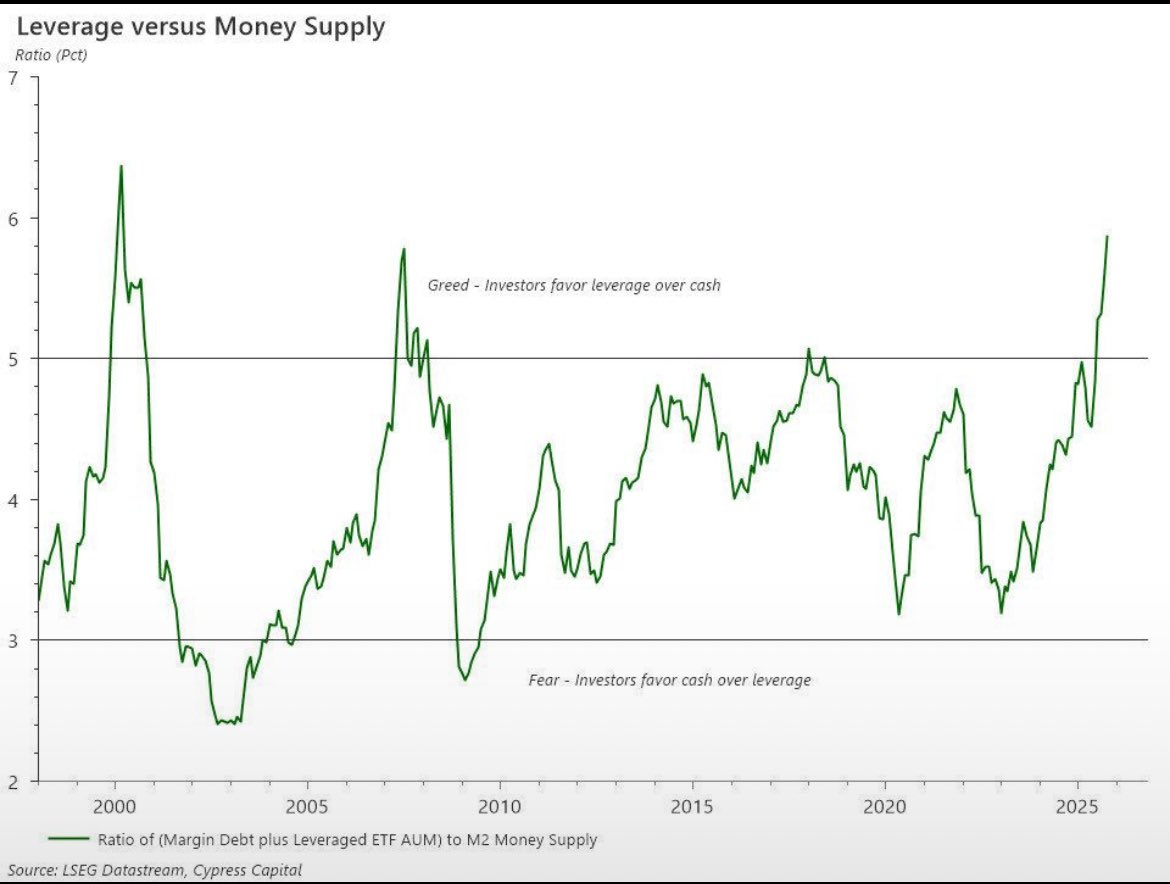

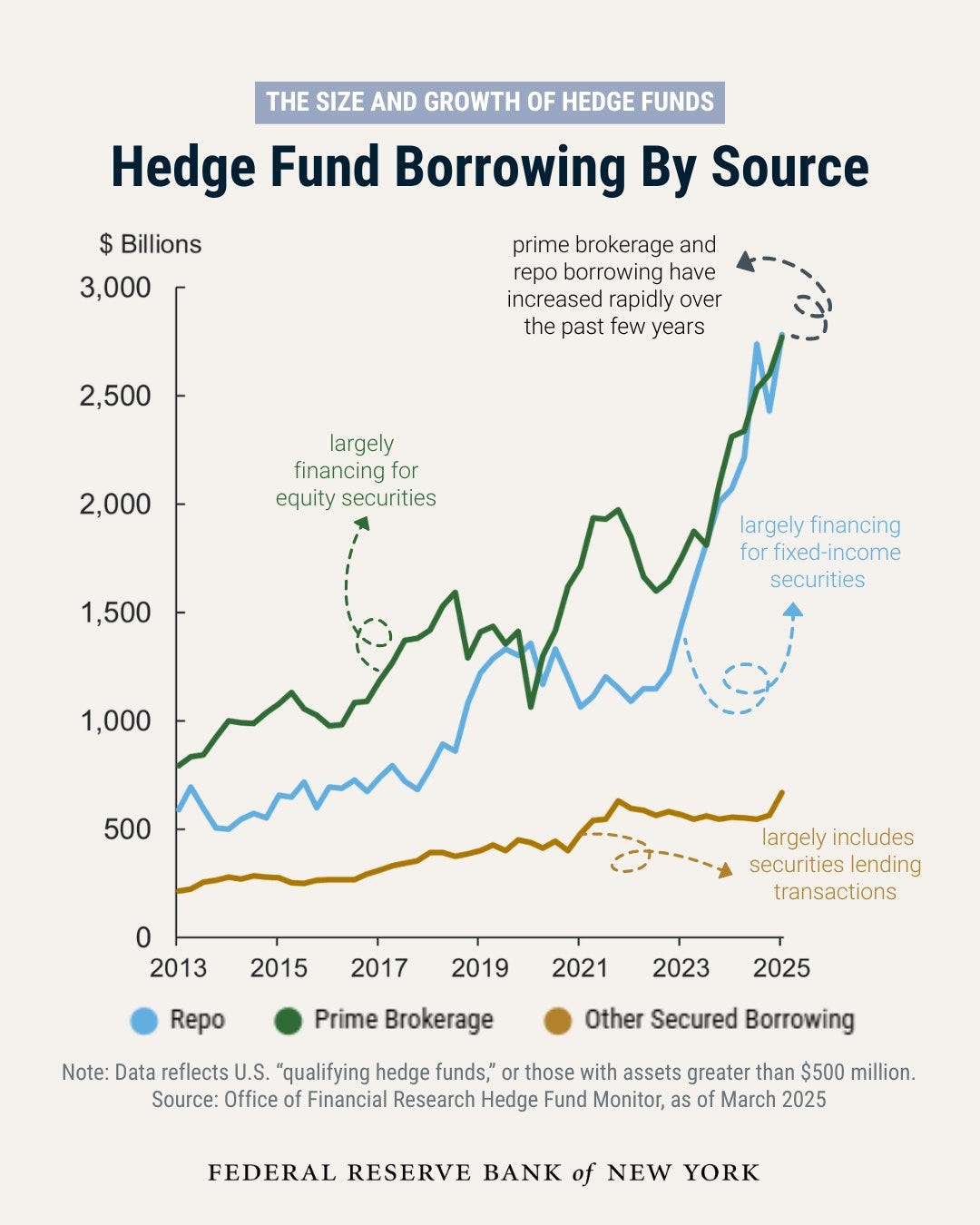

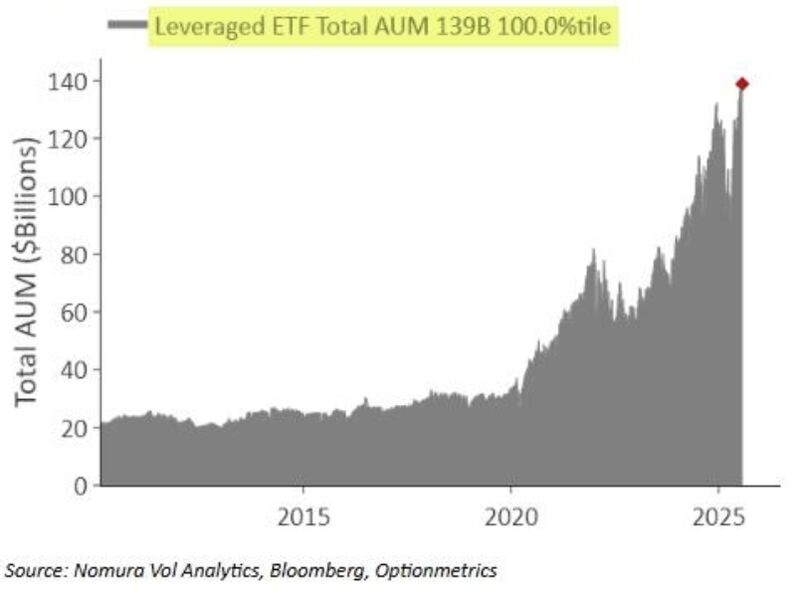

The Leverage Powder Keg

A hedge fund managing $1 billion with just $100 million of its own money (10:1 leverage) can turn a 1% market gain into a 10% return. That’s the allure of modern finance and the flaw that makes everything fragile.

The Fed gets it. The New York Fed highlighted how the “growing role of nonbank financial institutions” breeds systemic risk. It’s basically admitting defeat: Wall Street piles on more leverage than is safe, and policymakers lack the backbone to rein it in.

The Ignition Trigger; Rhythmical History

A sudden jump in market volatility.

Assets drop.

Leveraged hedge funds and ETF investors watch their positions lose value.

Lenders freak out. Prime brokers and repo market players slap on margin calls.

Fire sales explode. Funds unload assets to cover calls, driving prices lower and sparking more calls.

Past bailouts saved speculators but ignored the root cause; runaway leverage. Central banks and governments guaranteed the issues would resurface while their minions profited.

Today, leverage is higher than ever.

The Cayman Islands, hedge fund leverage central, ranks among the top holders of U.S. Treasuries. The world’s key bond market relies on offshore, loosely regulated funds placing high-stakes, high-leverage bets.

Auto Sector and Big Tech

Two examples show how leverage, secrecy, and accounting gimmicks are tainting key industries.

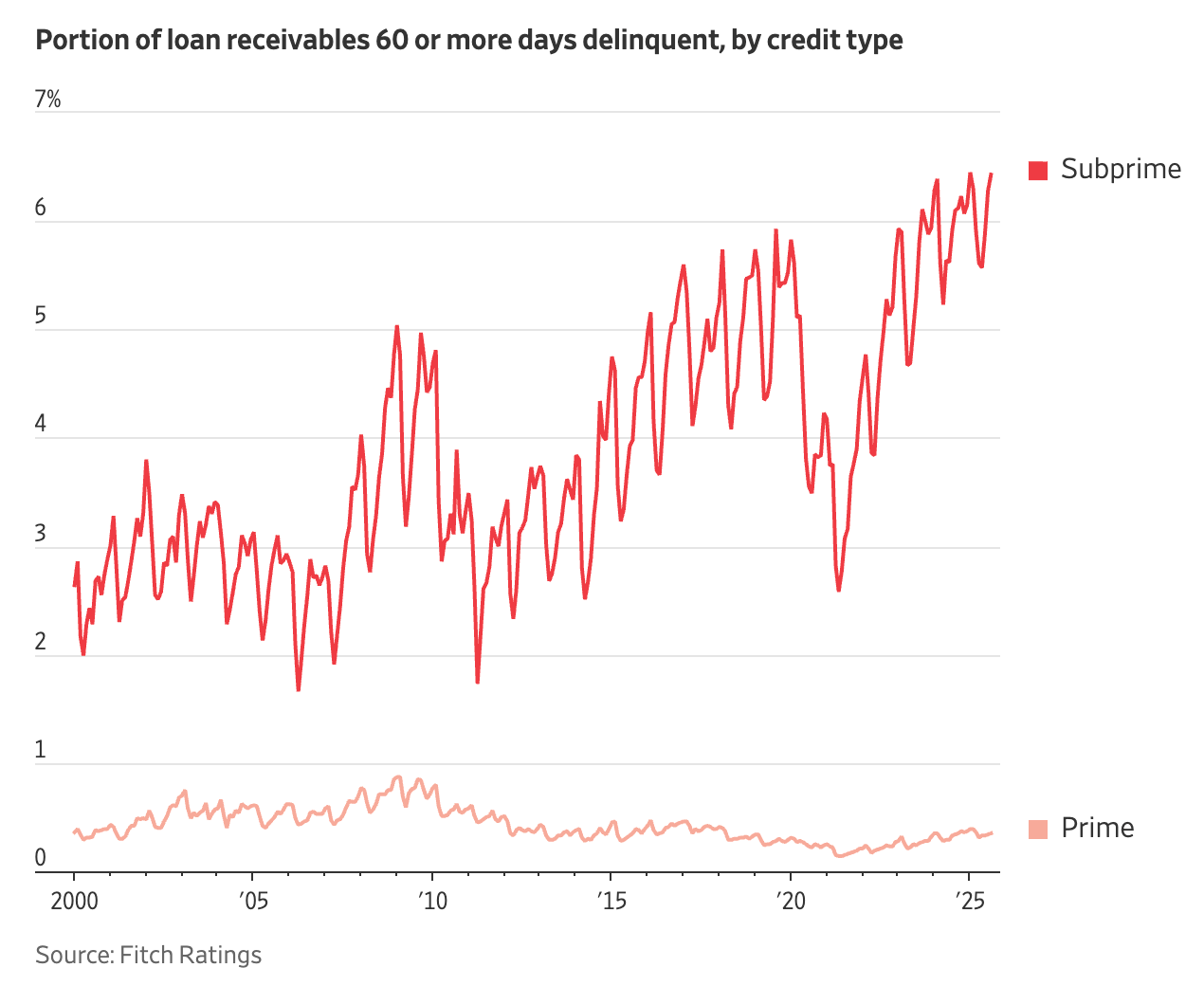

Auto Sector Weakness;

Two big auto players imploded at once; Tricolor (subprime auto lender); Over $1B in liabilities, 25,000+ creditors, major ties to JPMorgan Chase.

First Brands (key parts supplier); Up to $10B in liabilities, using “reverse factoring” to mask debt. Jefferies and UBS on the hook for over $1B.

Moody’s flags private credit in this space as a potential “contagion hotspot.”

Big Tech Accounting Games: Michael Burry (of The Big Short fame) warns that tech giants are stretching AI chip lifespans to inflate earnings and boost stocks.

Impact; $176B in deferred depreciation from 2026–2028.

If AI hardware cycles every 2–3 years, claiming 5–6-year lives smells like manipulation, not reality.

Reported Useful Life of AI Servers (Years)

Oracle ████████████████ 6.2

Meta █████████████ 5.8

Google ███████████ 5.0

Nvidia █████ 2.5 (actual turnover)An incomplete pic of how the AI industry is funding its own earnings. Like 1999 only different;

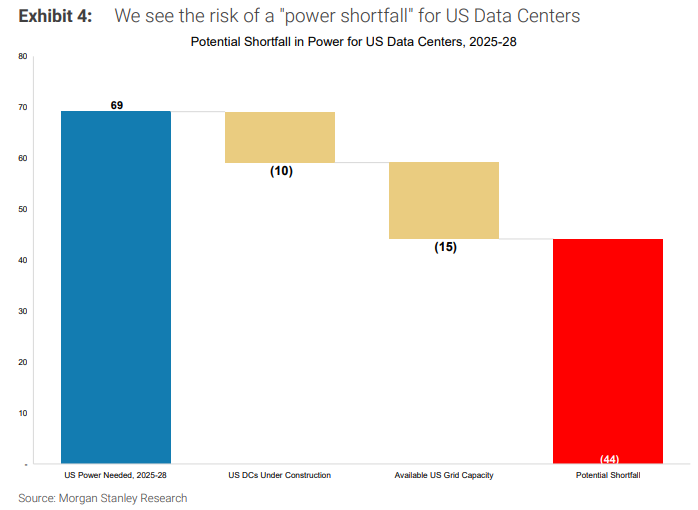

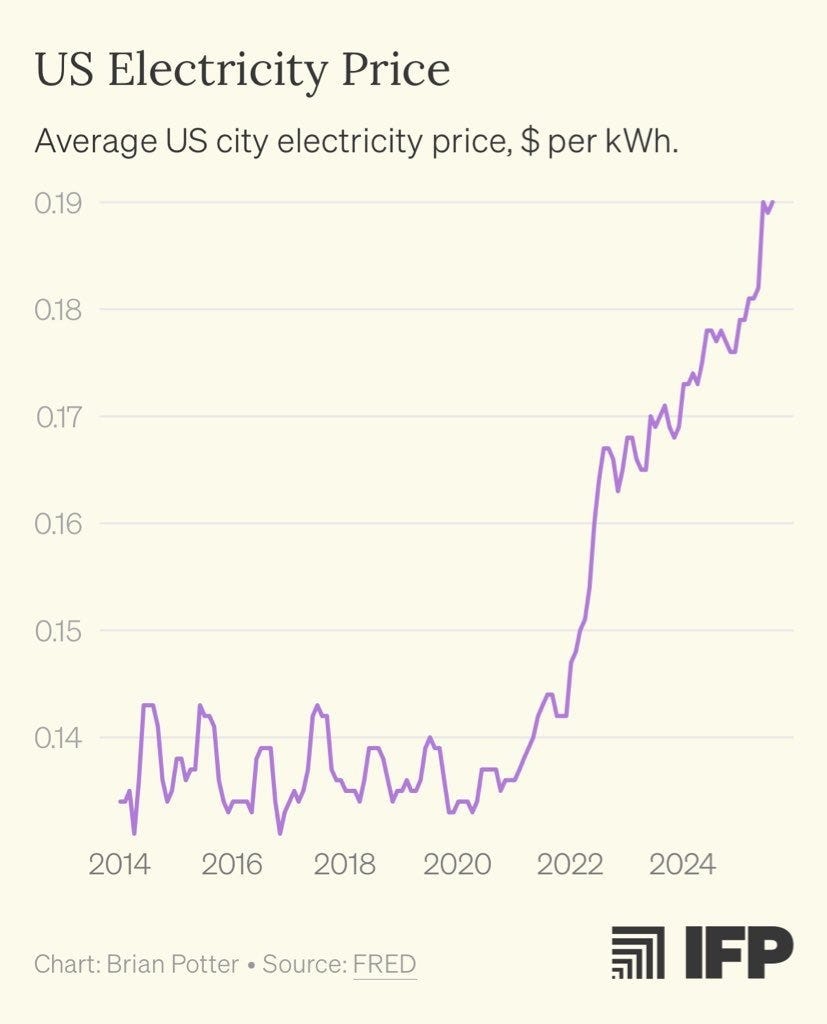

The Grid Breakdown; Physical Reality Clashing with Digital Hype

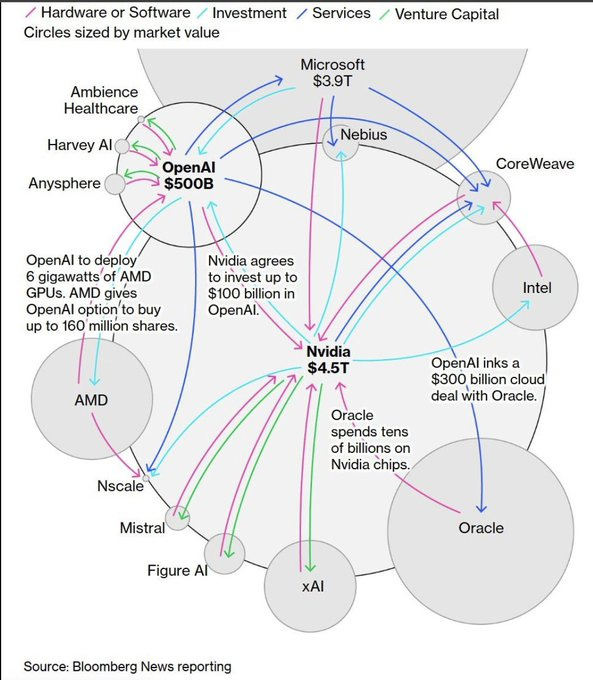

The U.S. power grid can’t handle AI and data center explosion. Hyperscalers (Amazon, Microsoft, Google, Meta, Oracle) are erecting facilities with power needs 10x traditional ones. Data Centers plan to gulp 9% of U.S. electricity by 2030 (from 2–3% now).

Energy supply isn’t keeping up;

Baseload plants (nuclear, coal) shut down faster than new ones rise.

Renewables are unreliable for 24/7 AI demands.

New transmission lines? 8–12 years to permit and build.

Utilities in Northern Virginia and elsewhere are rejecting or postponing data center hookups.

In hot spots, data centers are siphoning power from homes and factories.

The AI surge bets on endless energy. The grid begs to differ.

The Household Squeeze

Millions of American families are hitting breaking points.

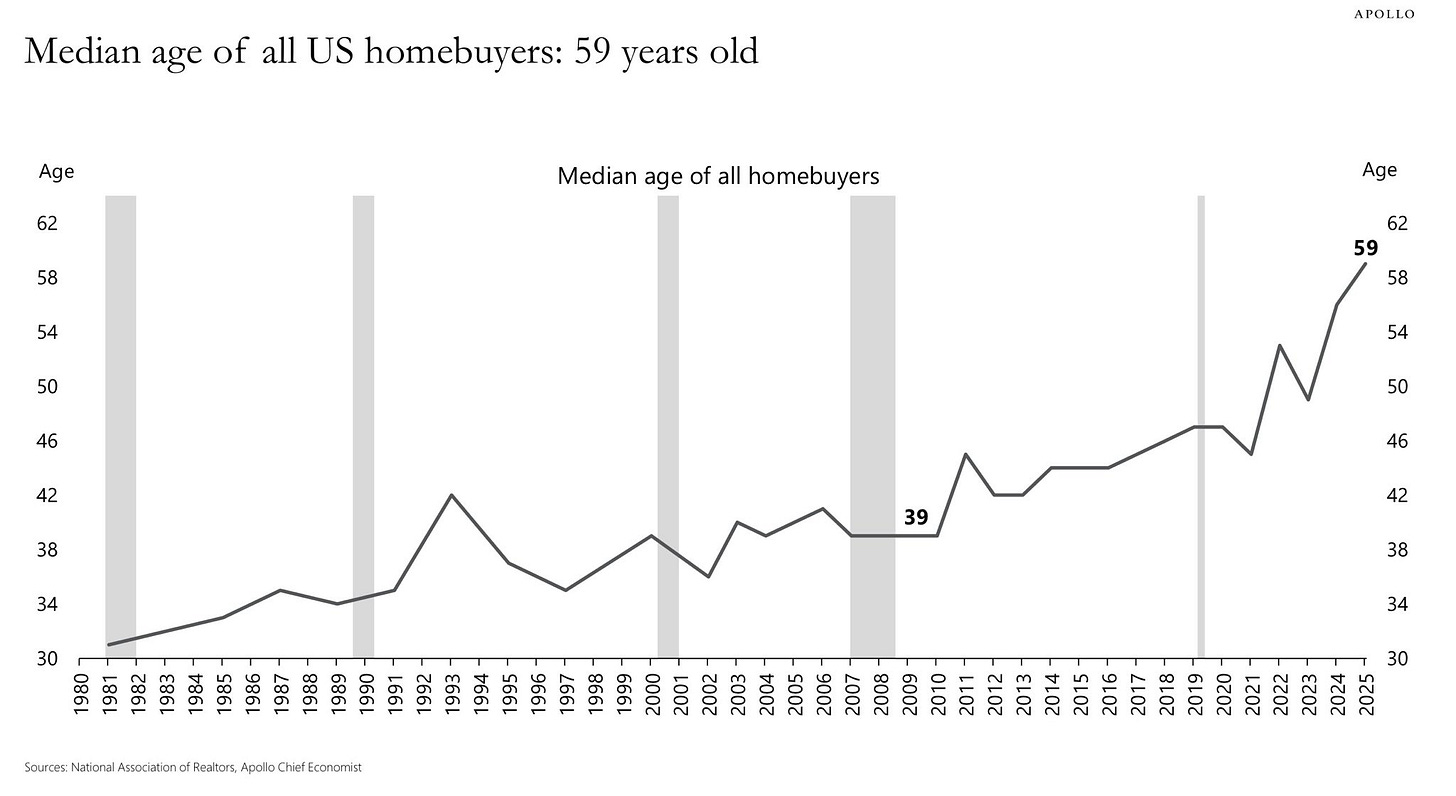

Unaffordable housing: Median home prices have soared past 7.5× median household income in many metros; 30-year mortgages at 7%+ require $100k+ incomes just to qualify for a starter home. Renters face 30–40% jumps since 2020, with eviction filings now exceeding pre-pandemic peaks.

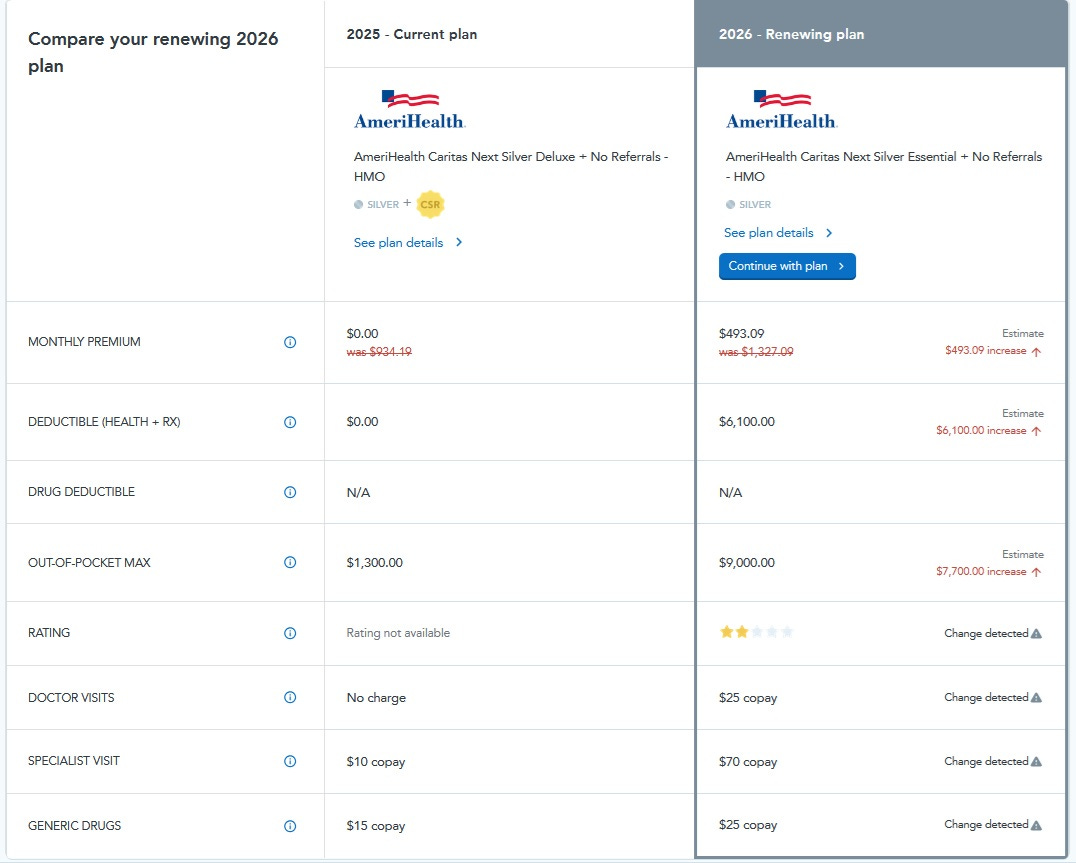

A year over year example of healthcare costs crushing budgets; ;

Student loan payments restart; 43 million borrowers resumed payments in late 2023 after a 3+ year pause. Monthly bills average $200–$400, draining discretionary spending and forcing defaults on other debts.

Food inflation erodes purchasing power; Grocery prices remain at least ~25% above 2019 levels. Proteins, dairy and staples lead the surge.

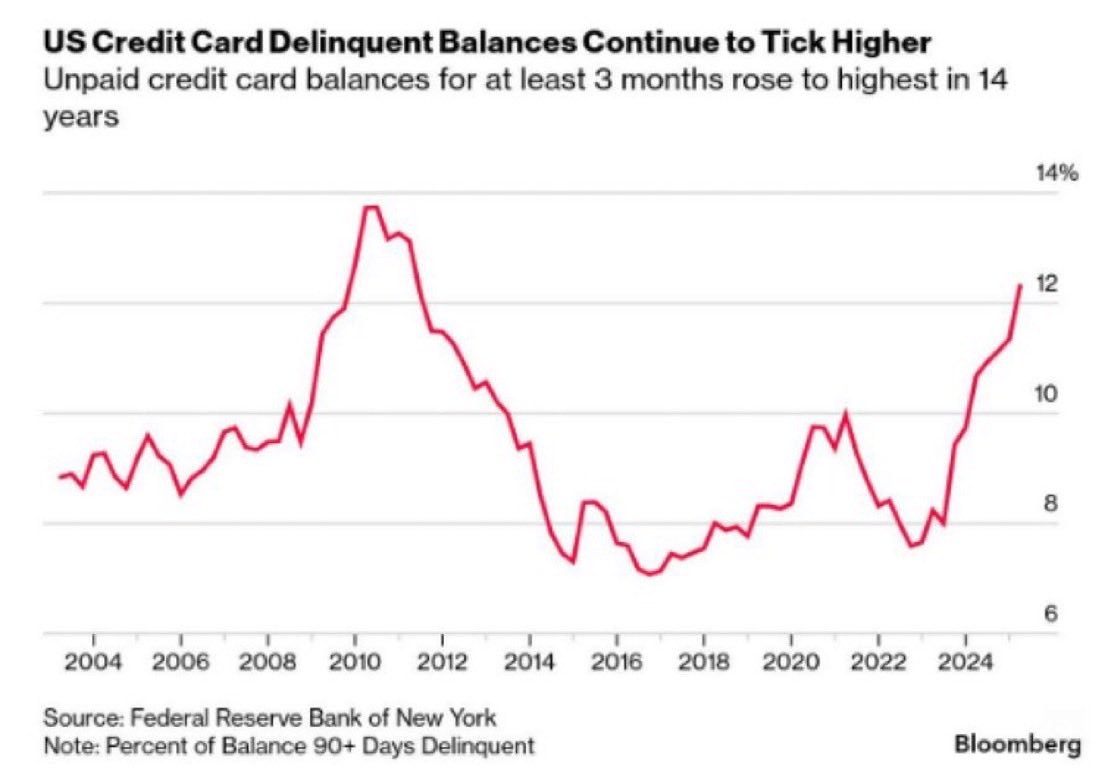

Over-leveraged consumers with maxed-out credit cards, depleted savings, and no room to absorb rate hikes or job losses.

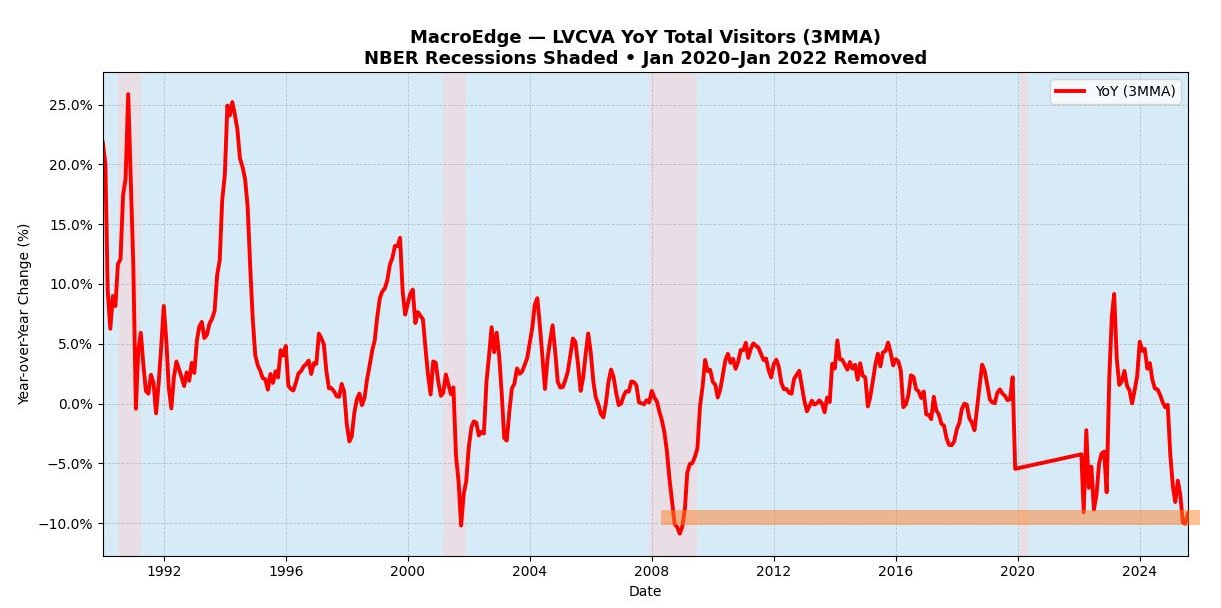

Vegas;

Corporate sleight-of-hand; From subprime autos to Big Tech, earnings and balances are propped up by tricks.

The grid can’t power the AI fantasy.

Families are tapped out on housing, healthcare, loans, and food

The Fed can pump liquidity. It can’t conjure collateral. It certainly can’t generate electricity. The alerts are out there. The data is public.

A pic of my foot;