Health Insurance Shock; 2026 ACA Premiums to Soar Across North Carolina

As COVID-era subsidies end, rate hikes of 25–40% will hit nearly a million residents as two insurers pull out of the state.

North Carolinians who buy their health insurance through the Affordable Care Act Marketplace are about to get some unpleasant news in the mail. Insurers across the state have received approval for substantial 2026 rate hikes, and they’ll take effect just as enhanced federal subsidies are scheduled to expire at the end of the year.

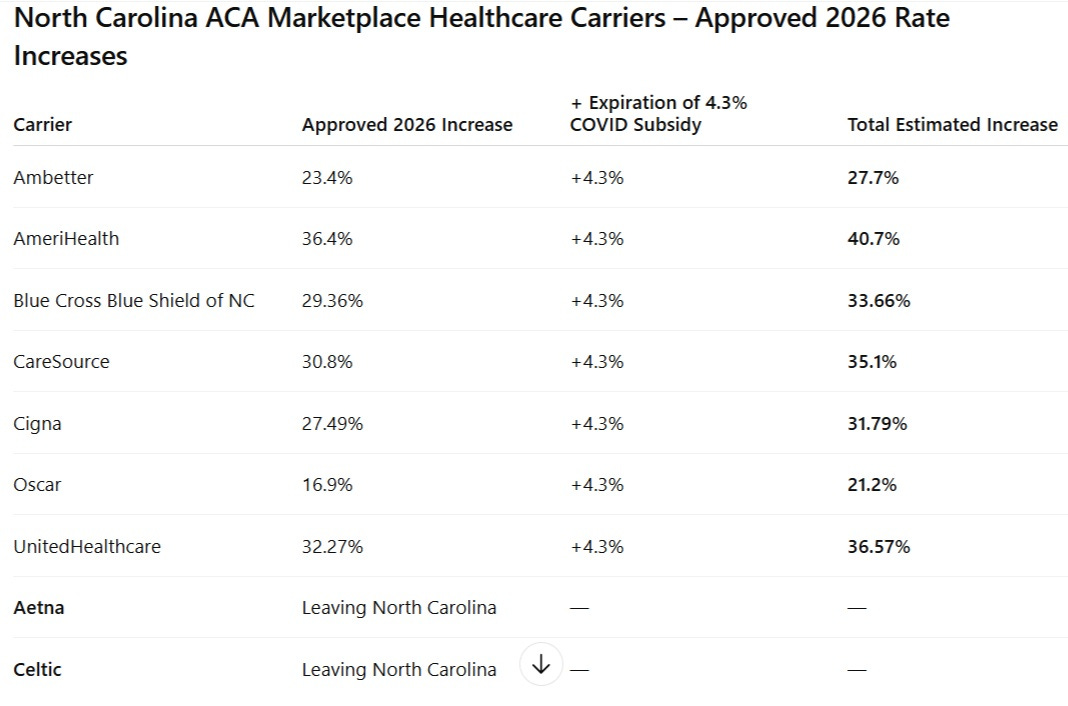

According to the North Carolina Department of Insurance, rate increases range from the high teens to over 36 percent depending on the company. When the 4.3 percent boost from the expiration of COVID-era subsidies is added, the effective increases climb even higher.

Roughly 925,000 North Carolinians are covered through ACA Marketplace plans. Since 2021, pandemic-era enhanced premium tax credits have helped about 888,000 people, or 96% of enrollees, afford coverage.

Those subsidies are set to expire December 31, 2025, unless Congress renews them.

Governor Josh Stein has warned that, without those credits, “the average Marketplace enrollee in North Carolina is expected to pay $672 more per year for the same health insurance,” even before accounting for the insurers’ newly approved rate hikes. Combined, the effect will mean hundreds of dollars more each month for many households.

Fewer Choices, Less Competition;

While nine companies offered Marketplace plans in 2025, Aetna and Celtic have announced plans to leave the state by year’s end, further limiting options.

The North Carolina Department of Insurance has warned that “many people will become uninsured” and that “younger and healthier people are expected to drop their coverages, leaving the pool more costly.” When that happens, the remaining risk pool grows older and sicker and everyone pays more.

The Domino Effect;

The problem doesn’t stop with the Marketplace. When more people go without coverage, hospitals and clinics shoulder higher uncompensated-care costs, which then get passed on to everyone—through higher premiums for private and employer-based plans.

It’s a self-feeding cycle;

Higher premiums → fewer insured → higher systemwide costs → even higher premiums.

Examples of Healthcare Premium Increases From Some States which opened 2025-2026 window-shopping tools;

Premium costs for the coming year will vary based on individual circumstances and selected coverage options. State marketplace window-shopping tools illustrate how expenses may escalate for households maintaining the same silver-level coverage from 2025 through 2026;

Virginia: A retired couple ages 50 and 51 in Roanoke with combined annual earnings of $85,000 faces monthly premiums jumping from $602 to $1,410, a 134% spike.

New York: A household of four in Rockland County earning $105,000 annually would experience their monthly silver plan premiums grow from $1,809 to $3,101, a 71% rise.

Nevada: A 61-year-old in Las Vegas with an annual income of $68,000 would see monthly premiums escalate from $505 to $1,179, a 133% increase.

Georgia: A 45-year-old single Atlanta resident earning $38,000 per year would face a particularly steep increase, with monthly premiums climbing from $185 to $477, a 158% jump.

Disclaimer: This article is based on publicly available information from the North Carolina Department of Insurance, federal filings, and statements from state officials as of October 2025. It is intended for informational and educational purposes only and should not be interpreted as financial, legal, or health insurance advice. Rate increase percentages reflect approved filings and estimated impacts from the expiration of temporary federal subsidies; actual costs to individuals may vary depending on income, household size, and plan selection. Readers are encouraged to verify details with their insurance provider or healthcare.gov before making coverage decisions.