Guilford County 2026 Property Revaluation; Data and Methodology Records Request

With links to related posts

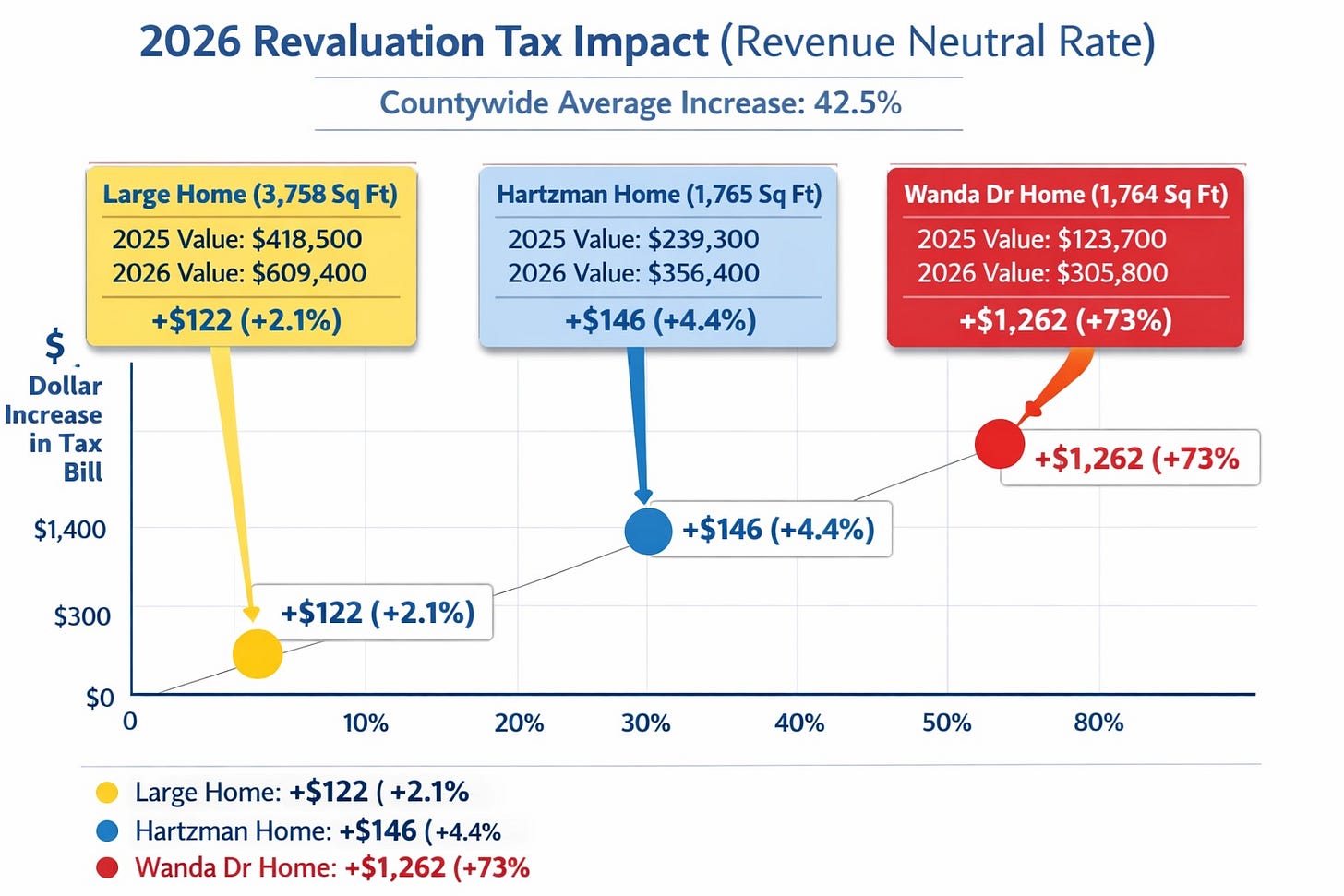

The Mayor of Greensboro’s house, my house and another I ran into.

“Revenue-neutral” only offsets the average increase. Properties that went up far more than the average end up paying a much larger dollar and percentage increase.

Meanwhile;

Larger homes with smaller relative increases (like the 3,758 sq ft property) barely see their bills rise.

Mid-sized homes like mine take a moderate hit, slightly above average.

This is a classic example of vertical inequity in property tax revaluations;

Lower-priced, previously undervalued homes can get hit the hardest.

Higher-priced homes often see only minor increases, even if their nominal values are huge.

It shifts the burden downward, despite the “neutral” label.

Despite a “revenue-neutral” valuation adjustment by Greensboro and Guilford County, the 2026 revaluation reveals a stark reality; homeowners with smaller or previously undervalued properties are facing the largest tax increases, while larger or already high-value homes will likely see only modest changes. In practical terms, this means that those least able to absorb rising costs are paying the steepest share of the tax burden. The uneven nature of these increases underscores the urgent need for transparency, accountability, and a revaluation process that ensures all residents are treated fairly, rather than quietly shifting costs onto the most vulnerable homeowners.

Pursuant to the North Carolina Public Records Law (N.C. Gen. Stat. §132-1), I respectfully request access to and copies of the following records related to Guilford County’s 2026 property revaluation;

1. Total taxable value for FY 2025 (the year immediately prior to the 2026 revaluation)

Total 2025 tax base by property class (residential, commercial, industrial, agricultural, etc.)

Total 2026 tax base by property class

Any exclusions or adjustments used in the calculations

2. Property Class Base Changes

Aggregate assessed value totals for 2025 and 2026 by property class

Percentage change in assessed value by class

Any internal analysis prepared regarding shifts in tax base composition

3. Market Area and Neighborhood Factors

Market area codes and neighborhood delineation maps

Neighborhood market adjustment factors used in the 2026 revaluation

Documentation showing how these factors were derived or calibrated

Sales ratio studies or coefficient of dispersion (COD) studies conducted for the 2026 revaluation

4. Cost and Depreciation Schedules

The locally adopted cost schedules used in the 2026 revaluation

Depreciation tables applied to residential properties

Quality grade definitions and adjustment tables

Land valuation schedules by market area

(If portions of the cost manual are proprietary, I request any locally adopted schedules, multipliers or adjustment factors used by Guilford County in applying the system.)

5. Comparable Sales Data

The sales dataset used to calibrate residential market values for the 2026 revaluation, including:

Sale dates

Sale prices

Parcel identification numbers

Market area assignments

Any exclusion criteria applied

Guilford County Public Records

Your record request #26-200 has been submitted successfully.

Thank you for contacting Guilford County. We have received your request and are working to determine if there are any responsive documents.

Public Records Request; 2026 Revaluation Distributional Impact Data

To: Guilford County Tax Department

Pursuant to the North Carolina Public Records Law (N.C. Gen. Stat. §132-1), I request access to and electronic copies of records sufficient to determine how the 2026 revaluation affected residential properties across different value tiers.

Specifically, I request the following;

1. Residential Value Distribution; Pre-Revaluation

For the last fiscal year immediately prior to the 2026 revaluation (FY 2025), please provide:

Total number of residential parcels

Assessed value of each residential parcel (parcel-level dataset preferred)

OR, if parcel-level data is not provided, a distribution table showing:

Number of residential parcels by assessed value ranges (e.g., <$150,000; $150k–$250k; $250k–$500k; $500k–$750k; $750k+)

2. Residential Value Distribution; Post-Revaluation (2026)

For FY 2026;

Assessed value of each residential parcel (parcel-level dataset preferred)

OR value distribution table using the same value bands as above

3. Change Analysis

Any internal analysis, summary tables, or reports showing:

Median residential assessed value in FY 2025

Median residential assessed value in FY 2026

Average percentage increase for residential parcels

Percentage increase broken out by value tiers (low, median, high value homes)

Any decile, quartile, or tier-based analysis conducted by the County

4. Sales Ratio and Equity Studies

Any coefficient of dispersion (COD), price-related differential (PRD), or vertical equity studies conducted in connection with the 2026 revaluation

Any analysis evaluating uniformity of assessment across value strata

If parcel-level data is provided, I request it in spreadsheet format (CSV or Excel), including;

Parcel identification number

2025 assessed value

2026 assessed value

Property class designation

Market area code

If any portion of these records is withheld, please cite the specific statutory basis for denial.

These records are requested to evaluate the distributional impact of the 2026 revaluation across residential value tiers.

Guilford County Public Records

Your record request #26-201 has been submitted successfully.

Public Records Request; 2026 Revaluation Equity & Calibration Data

To: Guilford County Tax Department

Pursuant to the North Carolina Public Records Law (N.C. Gen. Stat. §132-1), this is a supplemental request related to the 2026 property revaluation.

I request the following records;

1. Vertical Equity and Uniformity Studies

Any analyses conducted in connection with the 2026 revaluation measuring assessment uniformity or vertical equity, including;

Coefficient of Dispersion (COD) studies

Price-Related Differential (PRD) calculations

Stratified sales ratio studies by value tier

Decile or quartile-based assessment ratio analyses

Any regression output or statistical modeling used to test value uniformity across price ranges

If no such analyses were performed, please confirm in writing.

2. Sales Calibration Data

Records sufficient to show how residential market values were calibrated, including;

The sales cutoff date used for 2026 calibration

The full dataset of arm’s-length residential sales used in modeling (parcel ID, sale date, sale price, market area)

Criteria for excluding sales from analysis

Any weighting adjustments applied

Any documentation describing how changing market conditions (including interest rate increases) were incorporated into the valuation model

Electronic format (CSV or Excel) is preferred.

3. Neighborhood Market Adjustment Factors

The neighborhood or market area factor tables used for 2026

Documentation reflecting changes in market factors from the prior revaluation cycle

Any internal memoranda or reports explaining factor adjustments

4. Land and Improvement Modeling

Aggregate residential land value totals for FY 2025 and FY 2026

Aggregate residential improvement value totals for FY 2025 and FY 2026

Residential land valuation schedules by market area

Any revisions to land pricing tables adopted for 2026

5. Appeals and Informal Review Data (When Available)

Total number of informal review requests filed for 2026

Number and percentage resulting in value adjustments

Average percentage reduction granted

Distribution of reductions by value tier, if tracked

Guilford County Public Records

Your record request #26-202 has been submitted successfully.

Public Records Request; Median Residential Revaluation Data

To: Guilford County Tax Department

Pursuant to the North Carolina Public Records Law (N.C. Gen. Stat. §132-1), I am requesting the following information related to the 2026 residential property revaluation:

Requested Records;

Median-value home assessment changes for 2026

Median assessed value of residential properties for 2025

Median assessed value of residential properties for 2026

Median percentage increase by market area or neighborhood, if available

Any supporting data tables, reports, or calculations used to determine these median values

Stratified median information

Median increases for low-, mid-, and high-value residential properties, broken into deciles or quartiles

Documentation or calculations showing how these stratified medians were derived

Methodology Documentation

Any internal guidelines, formulas, or reports used to calculate the median and stratified median changes

Clarification on whether the median calculations account for sales exclusions, property exemptions, or abnormal market adjustments

Explanation of Request:

The purpose of this request is to evaluate the distributional impact and fairness of the 2026 revaluation. While the county has published average (mean) increases, averages can be skewed by extreme property value changes, making it difficult to understand the typical homeowner’s experience. Median values provide a more accurate picture of how most residents’ assessments changed and help identify whether the revaluation produces disproportionate tax impacts on lower- or higher-value homes.

Providing these records will allow independent analysis of vertical equity in the revaluation and support transparency in the property tax system.

Guilford County Public Records

Your record request #26-203 has been submitted successfully.