Greensboro’s New Council Faces a Test; Don’t Raid the Investments

Greensboro's $495.7 million

Greensboro’s city council has welcomed a slate of new members this year, bringing fresh energy and perspectives to local government. With new leadership often comes new priorities; housing, public safety, infrastructure and equity are all on the agenda. But one issue that may not make headlines, yet underpins everything else, is the city’s investment portfolio.

Why New Council Members Matter

Fresh oversight; New council members inherit fiduciary responsibility. They must ensure investments are managed prudently, with transparency and accountability.

Guardrails against temptation; When budgets tighten, it can be tempting to dip into investment earnings or principal to cover unfunded liabilities, pension shortfalls or looming bond payments.

Long-term stewardship; These funds are not designed to patch short-term gaps. They exist to safeguard the city’s financial health for decades, ensuring stability for employees, retirees and taxpayers alike.

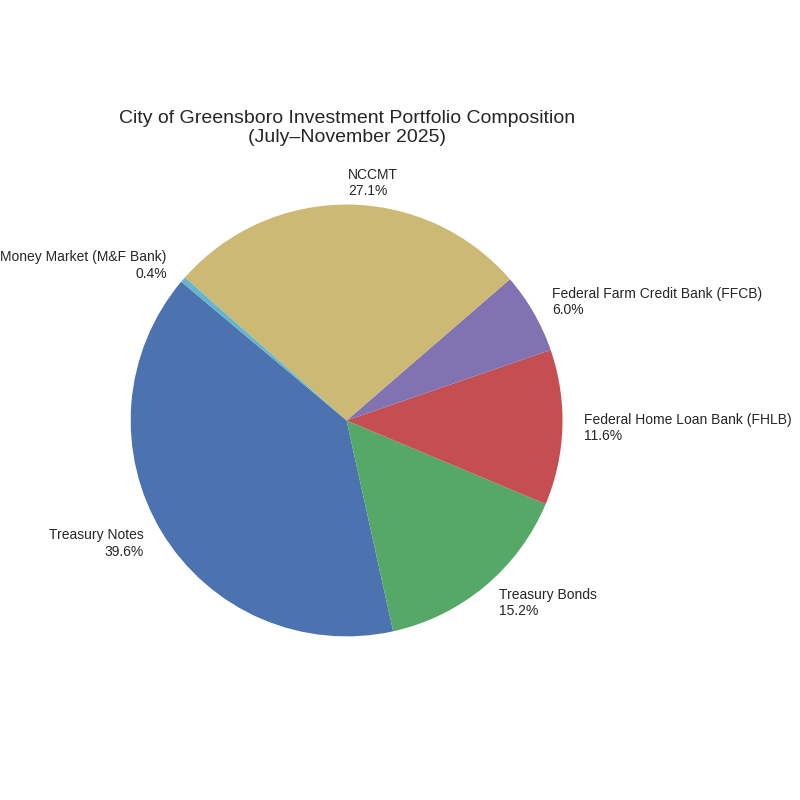

Greensboro manages a massive investment portfolio quietly generating millions in interest every year. A recently released general ledger from a public records request covering July through November 2025 provides a rare window into how that money is managed, and what it means for taxpayers and city employees.

Between July 1 and November 30, 2025, Greensboro reported;

Total investments; about $495.7 million

Interest/dividends received; $5.48 million in just five months

Accrued interest/dividends; another $2.49 million not yet paid out

It’s a sophisticated portfolio rivaling mid-sized endowments.

Where the Money Is Parked

The city’s investments are spread across several categories;

Treasury Notes & Bonds (≈ $271M); The backbone of the portfolio. Safe, liquid, and backed by the U.S. government. These alone generated more than $4.9 million in interest during the period.

Federal Home Loan Bank (≈ $57.6M); Regional bank securities, producing steady returns of about $313,000.

Federal Farm Credit Bank (≈ $30M); Agricultural lending securities, yielding $237,500.

Cash equivalents;

North Carolina Capital Management Trust (NCCMT); $134.5M

M&F Bank Money Market; $2.05M

Together, these holdings show Greensboro favors conservative, fixed-income investments, prioritizing safety and predictable returns.

The Danger of Misuse

Using investment income, or worse, principal, to pay for unfunded future liabilities or debt service is a slippery slope. It erodes the city’s financial cushion, undermines credit ratings and risks higher borrowing costs. Once reserves are tapped, rebuilding them is far harder than resisting the temptation in the first place.

A Call to Discipline

The new council must recognize that these monies are not a piggy bank. They are the backbone of Greensboro’s fiscal stability.

Protecting them means;

Ensuring fees are justified and not eroding returns.

Keeping investment income dedicated to its intended purpose; supporting long-term obligations, not masking short-term budget holes.

Greensboro’s new council members have a chance to set the tone for responsible governance. By guarding the city’s investments, they protect not only today’s taxpayers but also tomorrow’s public servants and residents. The ledger tells the story; the money is there, it’s working and it must not be misused.