Greensboro City Manager Nathanial "Trey" Davis Asks for Skybox Tickets from Zack Matheny’s Taxpayer Funded DGI

Potential Ethics and Legal Violations

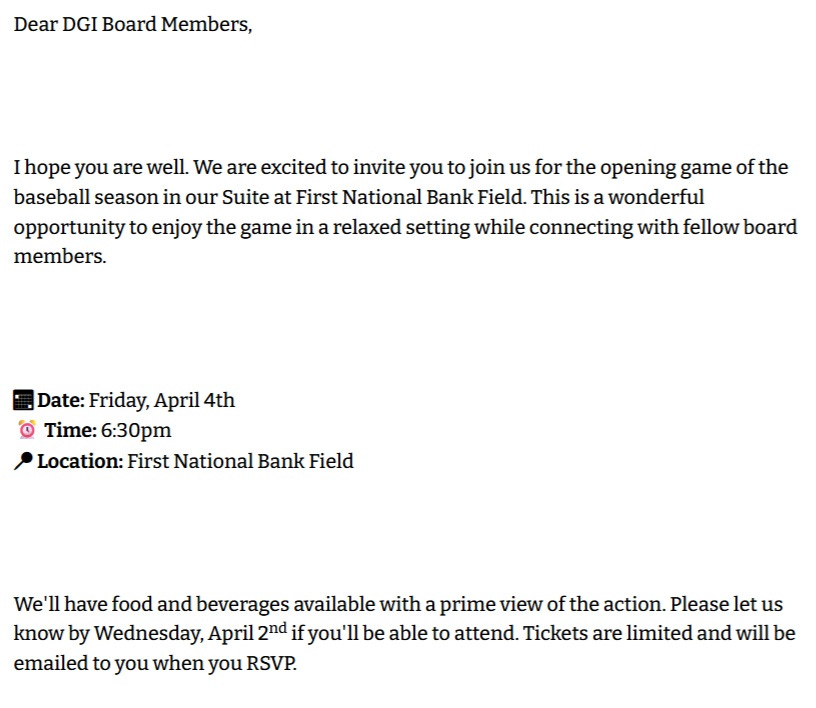

Zack Matheny, CEO of Downtown Greensboro Inc. (DGI) and a Greensboro City Council member, extended invitations to DGI board members on March 26, 2025, for an exclusive suite event at the Greensboro Grasshoppers opening baseball game on Friday, April 4th, at First National Bank Field.

Matheny included Trey Davis, inviting him to the Grasshoppers’ opening game in a luxury suite at First National Bank Field, which he should not have accepted.

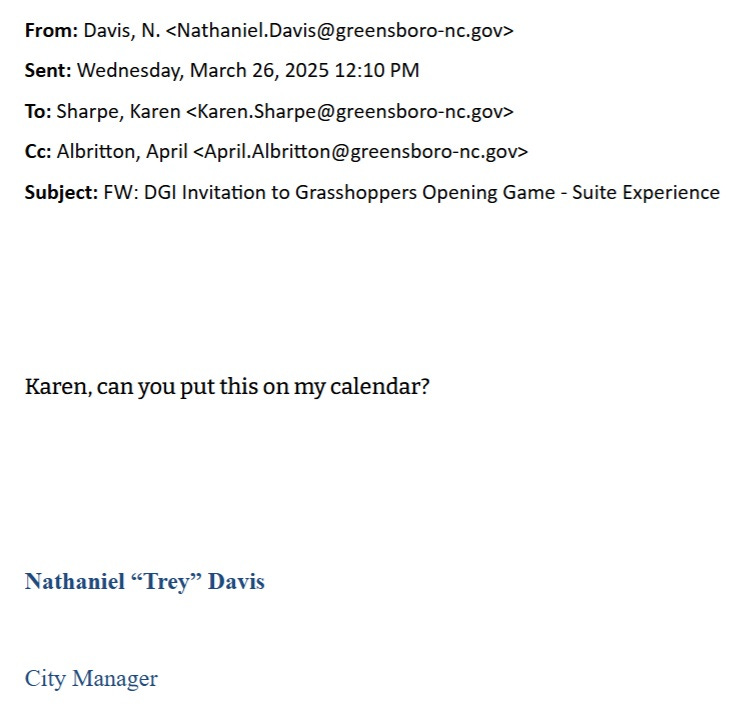

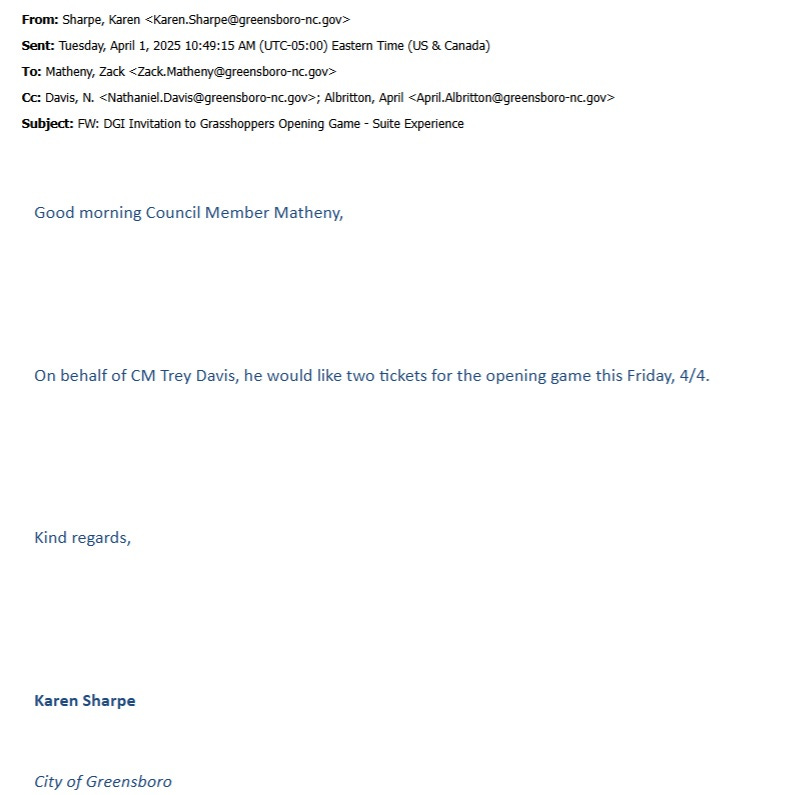

The invitation included food, beverages, and premium seating, funded by DGI, which receives taxpayer money from the City of Greensboro. Davis then asks Karen Sharpe to make it happen;

And she does, sending the email to Zack’s City Council email address, obviously by accident;

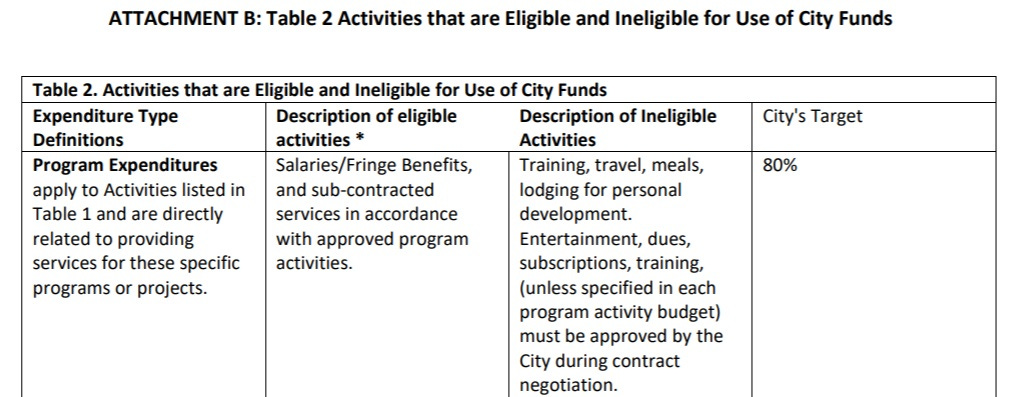

DGI’s contract with the City of Greensboro explicitly prohibits the use of public funds for ineligible activities such as entertainment, travel, meals and personal development.

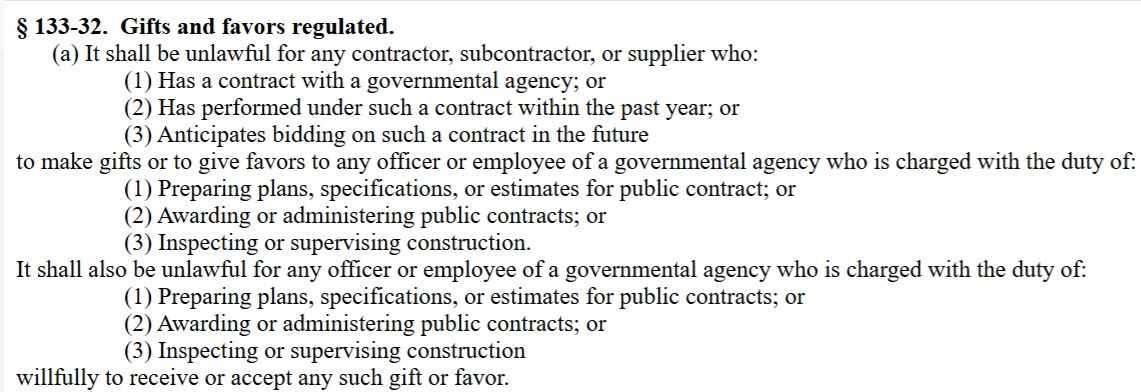

Under North Carolina law (NCGS § 133-32), it is unlawful for contractors, which includes DGI, to give gifts or favors to public officials involved in awarding or administering public contracts, which includes Davis. It was also illegal for Trey to accept such gifts, as the actions may constitute quid pro quo arrangements or outright bribery under state and federal law.

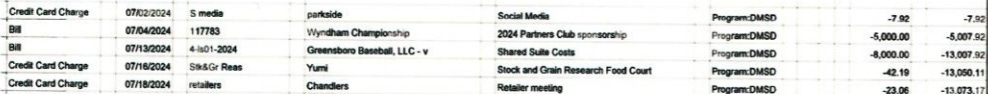

DGI’s expenditures on a Grasshoppers Suite potentially constitute violations of N.C. Gen. Stat. § 14-90 (embezzlement of public funds) and the IRS Private Benefit Doctrine for 501(c)(6) organizations. Coordinated gifts and board votes indicate a potential 18 U.S.C. § 371 (Conspiracy) charge against DGI board members and Greensboro's City Manager Nathanial 'Trey' Davis.

The event provided using DGI funds provided by Greensboro's taxpayers raises serious concerns under IRS § 4958 among other embezzlement, fraud and illegal gift giving by taxpayer funded government contractor statutes, which penalizes "excess benefit transactions" between nonprofits and their insiders. For instance, Trey Davis may qualify as a "disqualified person", someone who, within the past five years, could exert substantial influence over DGI’s operations. This provision is designed to prevent individuals in positions of influence from improperly benefiting from nonprofit organizations that receive public funding or tax-exempt status.

Given Davis's role as City Manager, he likely meets this definition due to his direct oversight of city contracts and budgets that impact DGI's operations.

Several factors demonstrate Davis's status as a disqualified person. First, as City Manager, he holds substantial influence over DGI's funding since the organization relies heavily on city contracts and taxpayer dollars. Second, DGI's reports acknowledge working "in conjunction with the City Manager's Office," showing his ongoing involvement in their operations. Third, the email evidence reveals Davis actively coordinating his attendance at the Grasshoppers game, further proving his connection to DGI's activities.

The legal implications of this relationship are significant. If the IRS determines that DGI provided Davis with benefits exceeding permissible limits, both parties could face severe consequences. DGI could be subject to excise taxes and potentially lose its 501(c)(6) tax-exempt status. For Davis, accepting such gifts could violate state laws against public officials receiving benefits from contractors, potentially leading to embezzlement or bribery charges under NCGS § 14-90 or federal statutes.

The troubling dynamic of a city council member who holds hiring and firing authority over the city manager, simultaneously serving as a city contractor while exchanging valuable perks with that same high-ranking official creates an undeniable appearance of impropriety.

If Trey Davis accepted suite tickets or similar gifts from DGI while Zack is both his evaluator and his benefactor, this could be viewed as coercive (if Trey felt pressure to accept or align with DGI interests), a form of soft bribery (where Zack indirectly rewards cooperation with perks funded by taxpayer dollars) and may violate the NC Ethics Act, which forbids gifts from “interested persons” doing business with the city.

When those who oversee city operations can also benefit financially from city contracts, while exchanging favors with the officials they're charged with supervising, it creates a toxic environment ripe for abuse. The public deserves assurance that decisions are made solely in the interest of taxpayers, not personal or political gain.

Without proper safeguards and investigations, such arrangements risk normalizing behavior that should be completely unacceptable in public service.

Please apply your abilities to the Regency Inn project for the homeless. It was awarded to DHIC from Durham estimated cost $29 million. Greensboro can’t afford any more mismanagement.