Folk Festival or Political Festival? Taxpayer Dollars Buy Perks for Greensboro Politicians

VIP for Votes? Greensboro Council Invited with $650 Tickets Plus Perks from City-Funded Festival

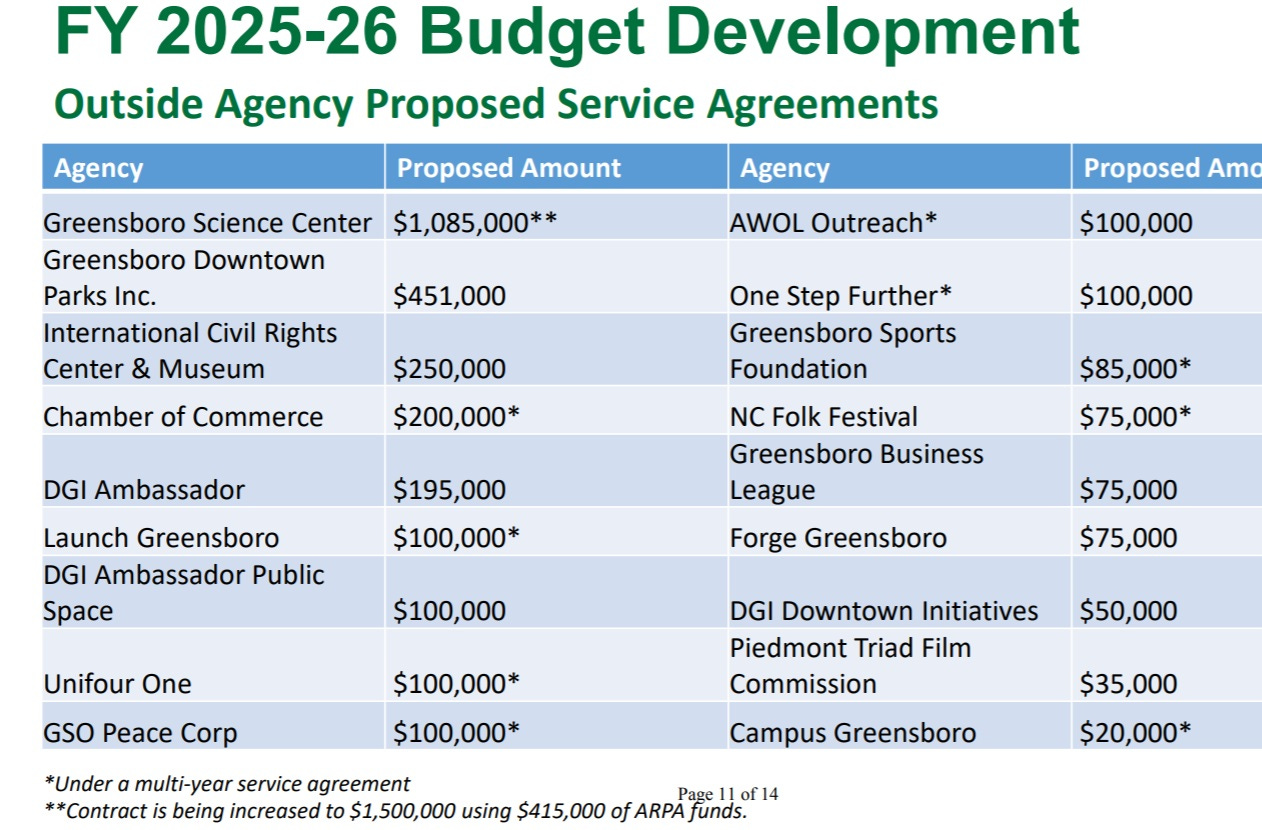

The City of Greensboro provides the North Carolina Folk Festival with $75,000 annually under a multi-year service agreement. Now, just weeks before a hotly contested municipal election, the taxpayer-funded contractor is offering City Councilmembers free VIP packages worth at least $650 apiece.

3-Day Package: $325 x 2 = $650.

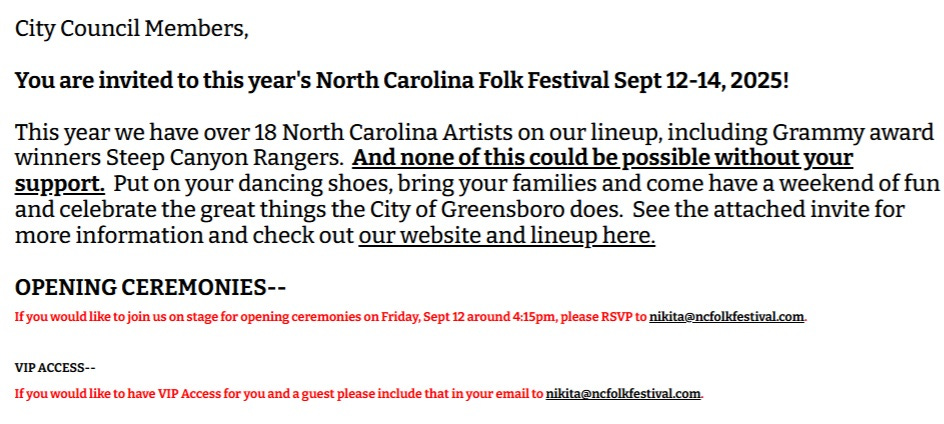

On August 21, 2025, NC Folk Festival Development Director Jodee Ruppel emailed every sitting councilmember, offering complimentary VIP passes for them and a guest:

What’s Included in the $650 VIP Package?

The VIP perks go well beyond a simple ticket. According to the Folk Festival, VIP access includes:

VIP Parking Pass – close-in parking to skip the hassle. VIP Check-in – avoid the main bar lines, purchase beer tickets directly. Exclusive VIP Areas at Every Stage. Shaded or tented seating (first come, first served). Free grab-and-go snacks all day. Complimentary water and non-alcoholic drinks. Free limited beer selection starting at 4:30 PM each day.

Main VIP Lounge;

Air-conditioned indoor retreat. Snacks, water, sodas, and alcoholic beverages served all day. Wyndham Championship CityStage (Headliner Stage). Reserved VIP seating and standing area under a front-stage tent. Clean, flushable bathrooms with doors, soap, and running water. Snacks and drinks available all day. Beer starting at 4:30 PM. Cocktails on Friday and Saturday evenings after 6 PM. Appetizers and light bites on Saturday night.

In other words, councilmembers weren’t just offered concert tickets—they were offered premium treatment, food, drinks, alcohol and comfort valued at hundreds of dollars more per person.

Because the NC Folk Festival is supported by $75,000 of Greensboro taxpayer money, the use of that funding to provide private, non-public benefits (alcohol, food, VIP seating, parking, bathrooms, etc.) for elected officials could constitute misapplication of public funds. In North Carolina, the misuse of taxpayer dollars for private enrichment can rise to the level of embezzlement of public funds (N.C.G.S. §14-90) or conversion of public funds to private use.

Side note; City Council Candidate Richard Beard is the CEO of the Sports Foundation; Mayoral Candidate Robbie Perkins is listed as President of One Step Further.

What makes this even more egregious is the nature of the perks themselves. We’re not talking about a seat in the grass or a free t-shirt—these are luxury amenities: catered appetizers, premium cocktails, all-day beer service, air-conditioned lounges, private bathrooms, and front-row access to headliner performances. When a taxpayer-funded contractor offers sitting politicians this kind of VIP treatment in the middle of an election season, it stops looking like community celebration and starts looking like a political favor dressed up as a party.

The fact that the festival’s leadership explicitly tied the offer to councilmembers’ support—“none of this could be possible without your support”—makes the transaction look like public money being laundered into private perks for politicians.

The offer wasn’t just for councilmembers. Each invite included a guest pass—doubling the value of the gift from $325 to $650. That means taxpayer-funded resources are not only subsidizing elected officials, but also their friends, family, or campaign allies.

The “plus one” provision magnifies the ethical problem because it extends the benefit beyond the officeholder to someone in their personal or political orbit. A councilmember could bring a spouse, a child, a donor, or even a campaign volunteer into the VIP section—enjoying food, alcohol, air-conditioned lounges, and prime seating all on the back of a publicly funded contract.

In effect, taxpayers are footing the bill for private entertainment of politicians and their associates. This isn’t just a perk; it’s a taxpayer-subsidized gift of luxury hospitality.

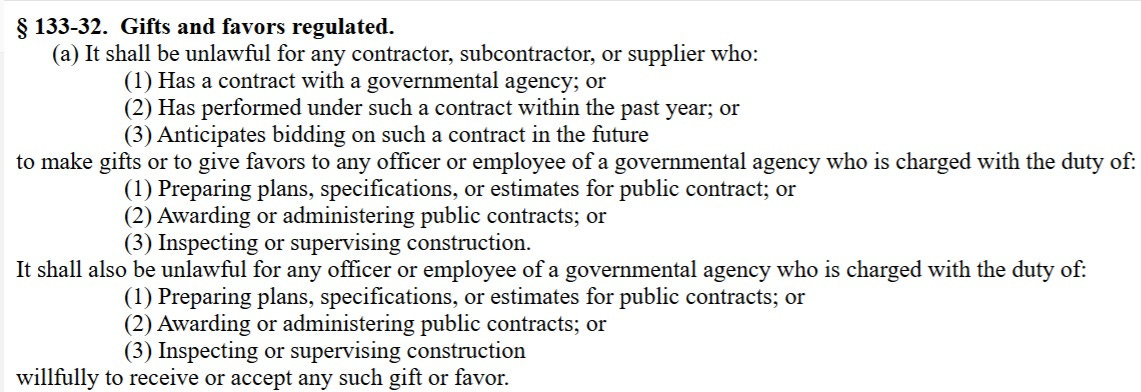

Gifts from Contractors Are Illegal in North Carolina

North Carolina law is clear. Under **N.C.G.S. §133-32**, contractors and vendors who receive taxpayer dollars may not provide gifts of value to public officials who make or administer contracts. City Council votes on budgets and funding agreements that directly benefit the NC Folk Festival, meaning they unquestionably "make or administer" its contract.

This isn’t just questionable hospitality—it looks like the misuse of public funds. When taxpayer-supported dollars flow through a city contractor and come out the other side as private perks for politicians and their guests, it begins to look like conversion of public money to private use. Under North Carolina law, that’s the territory of embezzlement of public funds (N.C.G.S. §14-90). In practical terms, the City of Greensboro appropriates money for a cultural event, and those funds are being leveraged to provide luxury benefits for officeholders and their plus-ones. That isn’t public service—it’s taxpayer-subsidized entertainment for the politically connected.

A $650 VIP package is more than a token. It’s a direct, tangible benefit from a city-funded contractor to elected officials. Accepting it would almost certainly violate the statute.

It was also illegal for councilmembers to accept such gifts, as the actions may constitute quid pro quo arrangements or outright bribery under both state and federal law. North Carolina’s gift ban already prohibits contractors from offering things of value to public officials who control their funding. But when elected officials accept those gifts—especially in the middle of an election year—it crosses into even more dangerous territory. The law doesn’t require an explicit deal to prove corruption; the appearance that taxpayer-supported perks could influence official decisions is enough to erode public trust and potentially trigger criminal scrutiny.

An In-Kind Campaign Contribution?

The situation is even more troubling in an election year. Every sitting councilmember is on the ballot in 2025. Providing VIP access at no charge is the functional equivalent of an **in-kind campaign contribution**—something of value given to candidates. Campaign finance law requires contributions to be reported and subject to limits, especially when the donor is a nonprofit corporation that receives public funds.

In short: taxpayers are subsidizing a contractor that is now handing out private perks to incumbents during campaign season.

Even if councilmembers decline the offer, the fact that it was made at all undermines public confidence. Taxpayer-funded nonprofits should never be in the business of conferring personal benefits to the politicians who decide their budgets.

At a minimum, this episode highlights the urgent need for stronger oversight of how public dollars flow through private organizations. At worst, it suggests a serious breach of ethics and election law.

Public records also show additional Folk Festival expenses funneled through DGI, including payments for performances and reimbursements to individual artists. For example, in September and October 2023, records list:

$500 to Deep Roots Market for Folk Festival performances.

$350 reimbursed to performer Sheena White.

$1,000 to Greensboro Brew Lab, LLC for weekend performances and lawn service.

Multiple taxpayer-supported nonprofits and public agencies also contribute, creating a complex web of public dollars supporting the event. With so many layers of taxpayer funding, the VIP perks for councilmembers—and their plus-ones—represent just the tip of the iceberg, raising serious questions about oversight and the proper use of public resources.

Bottom Line:

$650 VIP perks for elected officials—funded by a taxpayer-supported contractor—are not just bad optics. They are potentially illegal gifts under N.C.G.S. §133-32 and may amount to unreported in-kind campaign contributions. Greensboro voters deserve better than incumbents dancing in the VIP section on the public’s dime. It was also illegal for councilmembers to accept such gifts, as the actions may constitute quid pro quo arrangements or outright bribery under both state and federal law. The appearance that taxpayer-supported perks could influence official decisions is enough to erode public trust and potentially trigger criminal scrutiny.